POSTED

June 30, 2025

Solar Impact Investing: How Everyday Investors Drive Massive Environmental Change

Imagine standing at the edge of a solar farm, panels shimmering in the sun, and realizing that your dollars, deployed through solar impact investing, brought those panels to life. Thanks to innovative vehicles like Shasta Power Fund II, everyday investors can now turn personal capital into utility-scale clean-energy projects and drive measurable environmental change. Why […]

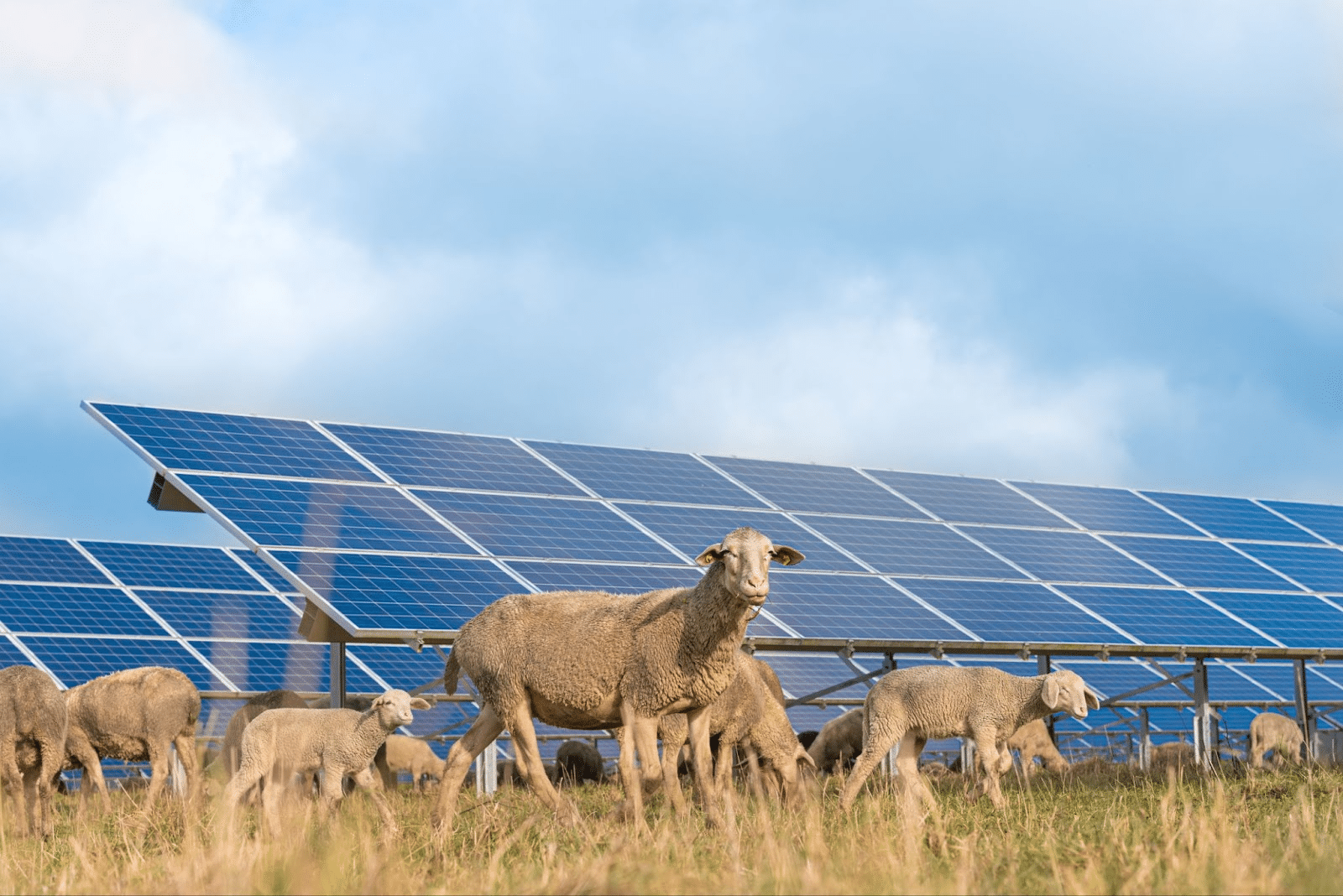

Imagine standing at the edge of a solar farm, panels shimmering in the sun, and realizing that your dollars, deployed through solar impact investing, brought those panels to life. Thanks to innovative vehicles like Shasta Power Fund II, everyday investors can now turn personal capital into utility-scale clean-energy projects and drive measurable environmental change.

Why Solar Impact Investing Outperforms Traditional Green Funds

Investing in a solar project isn’t just symbolic. It’s measurable. For example, High Point Solar (a project from our last fund), targeting construction in 2028, is a proposed 226-megawatt project that, once built, will produce enough electricity to power 42,000 homes and offset 325,000 metric tons of CO₂ per year.

Projects like these will deliver real climate impact, and with Shasta Power, you can help fund the next one. Our focus is building utility-scale solar with verifiable results: clean megawatt-hours delivered, emissions avoided, and healthier communities powered by sunlight.

Clean Air, Water, and Land

Beyond carbon cuts, solar impact investing improves air quality and conserves water. Shasta’s solar projects also reduce harmful pollutants, such as nitrogen oxides and sulfur dioxide, which are linked to respiratory illnesses and smog. Between 2019 and 2022, similar renewable projects prevented up to 1,600 premature deaths annually by improving air quality, Lawrence Berkeley National Lab.

Unlike fossil fuel plants, solar uses almost no water to generate electricity. That means our projects help preserve rivers, aquifers, and water supplies, which are critical in drought-prone areas. We also prioritize biodiversity, using native vegetation and land stewardship strategies that restore habitats and improve soil health NREL.

What Investors Get

When you invest in Shasta Power Fund II, your capital goes directly toward developing solar farms, not trading shares or buying into ambiguous ESG portfolios. This is impact investing with clarity:

- Every Megawatt-Hour Matters: Once constructed, each MWh of clean power avoids roughly 0.85 to 1.13 metric tons of CO₂.

- Traceable Results: During development, your dollars fund engineering, environmental, and cultural surveys, permits, land acquisition, and other development activities before construction and operation.. We estimate and report the environmental impact.

Powered by People

Through Regulation A+, Shasta Power Fund II opens investment to non-accredited retail individuals—a key part of our mission to democratize clean energy finance. Even modest investments can help finance large solar farms that reduce emissions, improve energy resilience, and support local economies.

This is not theoretical. Our previous projects prove that well-capitalized, community-supported development accelerates timelines and impact. With each new investor, we get closer to building more clean energy, faster.

The Power of Collective Investment

What makes Shasta Power Fund II especially transformative is how it harnesses the collective strength of everyday investors. Individually, a few hundred or thousand dollars may seem modest. But together, that capital aggregates into the tens of millions needed to bring utility-scale solar projects to life.

For example, if 500 people each invest $10,000, that’s $5 million—enough to fund a multi-megawatt solar project capable of powering thousands of homes annually. This people-powered model fosters shared ownership in the clean energy transition and accelerates project development timelines. The result? More solar built, faster.

Every investor becomes part of a broader climate mission, turning personal savings into infrastructure that reshapes communities and reduces emissions. With Shasta Power, your investment doesn’t just sit in a fund—it helps to start a solar farm.

A Better Alternative to Solar Stocks

Some investors consider buying shares in solar companies. However, this approach doesn’t always translate to a positive environmental impact. Stock purchases don’t fund new projects. They simply transfer ownership.

Shasta’s model is different. Every dollar invested goes into the physical development of solar farms. We acquire land, manage permitting, conduct surveys, manage preliminary design and engineering, negotiate grid interconnection agreements, acquire power purchase agreements, and deliver shovel-ready projects to the market for a profit. It’s a direct, traceable, and high-impact investment.

Measuring Impact and Building a Legacy

Shasta Power isn’t just developing solar projects—we’re building a long-term platform for measurable, mission-aligned investing. Our 10-year vision is bold: to develop 6 gigawatts of carbon-neutral power and bring renewable energy to 3 million people.

As an investor, you’ll receive monthly updates in an investor newsletter that track not just financial performance, but also development progress and ultimately climate outcomes. It’s part of our commitment to full transparency and to helping investors understand the real-world impact of their capital.

This is a positive impact that you can see, measure, and be proud of. You’re not just investing for returns—you’re helping write a new chapter in America’s energy future.

Your Climate Legacy Starts Here

Shasta Power exists to make solar investing accessible, transparent, and transformational. Through Shasta Power Fund II, you don’t just earn potential returns—you help power homes, decarbonize the grid, and protect ecosystems.

If you’re ready to align your money with your values and be part of a clean energy future, Shasta Power Fund II is your opportunity.

Learn more or get started at Shasta Power Fund II.