POSTED

October 17, 2025

What Are ESG Metrics and Why Do They Matter?

We know what ESG is, but how exactly is it measured? This article breaks down the various methods and criteria used to determine ESG scores and how it relates to your investment portfolio.

Environmental, Social, and Governance (ESG) metrics have evolved from peripheral considerations to core components of modern investment analysis. Yet despite their growing influence on capital markets, confusion persists about what these metrics actually measure and how they apply to real investment decisions.

At their core, ESG metrics are quantifiable data points that help investors assess how companies and projects manage sustainability-related risks and opportunities. These are measurable factors that increasingly correlate with financial performance. For investors evaluating opportunities in sectors like renewable energy, understanding ESG metrics has become essential for comprehensive due diligence.

Understanding the Three Pillars

Environmental Metrics: Measuring Impact on Natural Systems

Environmental metrics quantify a company or project’s interaction with the natural world. These measurements have become increasingly sophisticated, moving beyond simple pollution measures to encompass complex lifecycle analyses and ecosystem impacts.

Carbon emissions represent the most widely tracked environmental metric, typically categorized into three scopes. Scope 1 covers direct emissions from owned or controlled sources. Scope 2 includes indirect emissions from purchased electricity, steam, heating, and cooling. Lastly, Scope 3 encompasses all other indirect emissions in the value chain, from supplier activities to product end-of-life disposal. According to the Greenhouse Gas Protocol, which established these standards, Scope 3 often represents the largest portion of total emissions but remains the most challenging to measure accurately.

Beyond carbon, environmental metrics track energy consumption and efficiency ratios, water usage and management practices, waste generation and recycling rates, and impacts on land use and biodiversity. Each industry faces different material environmental factors meaning that what matters for a manufacturing company may differ substantially from what matters for a solar farm.

Social Metrics: Assessing Human and Community Impact

Social metrics evaluate how organizations interact with employees, communities, customers, and society at large. These factors, while sometimes viewed as “softer” than environmental metrics, significantly influence operational success and long-term value creation.

Workforce safety leads social metrics in most industries, tracked through injury rates, lost-time incidents, and safety program effectiveness. The United States Bureau of Labor Statistics provides industry benchmarks that allow for comparison across sectors. Employee diversity and inclusion data—measuring representation across gender, ethnicity, and other dimensions—has gained prominence as research demonstrates links between diverse teams and improved performance.

Community engagement metrics are designed to assess local economic impact, including job creation, procurement from local suppliers, and infrastructure investments. Supply chain labor practices examine working conditions, fair wages, and human rights compliance throughout vendor networks. Lastly, customer satisfaction and access metrics evaluate service quality and (particularly relevant for utilities) energy affordability and reliability.

Governance Metrics: Evaluating Management and Oversight

Governance metrics assess the systems, processes, and structures that direct and control organizations. Strong governance correlates with better risk management, strategic decision-making, and stakeholder alignment—factors that directly influence investment outcomes.

Board composition and independence metrics evaluate director qualifications, diversity, tenure, and freedom from conflicts of interest. Executive compensation structures examine alignment between pay and performance, particularly regarding long-term value creation versus short-term gains. According to 2024 disclosures, 77.4% of S&P 500 companies incorporate ESG performance measures into executive compensation design, demonstrating widespread recognition that sustainability factors influence business performance. This integration varies by industry, with some sectors more extensively linking pay to ESG outcomes than others.

Ethics and compliance programs, measured through training completion rates, hotline usage, and violation remediation, indicate cultural health and regulatory risk. Risk management frameworks assess identification, monitoring, and mitigation processes for both traditional and emerging risks, including climate-related threats. Transparency and disclosure practices evaluate the quality, frequency, and accessibility of reporting to stakeholders.

Why These Metrics Matter for Investors

Risk Management Perspective

ESG metrics help identify risks that traditional financial analysis might overlook. Research from the NYU Stern Center for Sustainable Business analyzing over 1,000 studies found a positive correlation between ESG performance and operational metrics including lower downside risk. This risk identification capability has contributed to growing adoption among institutional investors seeking to enhance risk-adjusted returns.

Operational risks often surface first through ESG metrics. Declining safety statistics might precede major incidents that trigger regulatory action, litigation, and reputational damage. Water stress metrics can identify facilities vulnerable to disruption before shortages impact production. Governance red flags, such as board entrenchment or weak oversight, correlate with higher probability of strategic missteps or compliance failures.

Research consistently shows that companies with strong environmental management systems (EMS) face fewer regulatory actions and maintain more cooperative relationships with oversight agencies. For example, research has shown that firms adopting ISO 14001 operate as part of “green clubs,” where members typically demonstrate stronger compliance than non-participants. The United States Environmental Protection Agency’s former Performance Track Program explicitly rewarded companies with robust EMS and strong performance by lowering inspection frequency and reducing administrative burdens. More broadly, this “license to operate”—the acceptance of business activity by regulators, investors, and communities—depends increasingly on demonstrated ESG performance.

Physical climate risks, from flooding to heat stress, threaten asset values across sectors. The Network for Greening the Financial System, comprising 127 central banks and supervisors, explicitly recognizes climate change as a source of financial risk. ESG metrics help quantify exposure and preparedness, informing everything from insurance pricing to loan underwriting.

Opportunity Identification

Beyond risk mitigation, ESG metrics help identify companies and projects positioned to capture emerging opportunities. This forward-looking perspective recognizes that sustainability trends create markets, not just constraints.

Access to capital increasingly depends on ESG performance. Green bonds and sustainability-linked loans offer lower financing costs for qualifying projects. According to the Climate Bonds Initiative, global green bond issuance exceeded $500 billion in 2021, with solar projects among the largest use categories. Strong ESG metrics facilitate access to this growing pool of preferential capital.

Companies that score well on ESG are increasingly rewarded in the market with what practitioners and researchers call a valuation or “ESG” premium. A comprehensive meta-analysis by NYU Stern’s Center for Sustainable Business found that a plurality of corporate studies show a positive relationship between ESG performance and financial outcomes, supporting the broad link between ESG quality and valuation-related metrics.

ESG Metrics in Action: Utility-Scale Solar Case Study

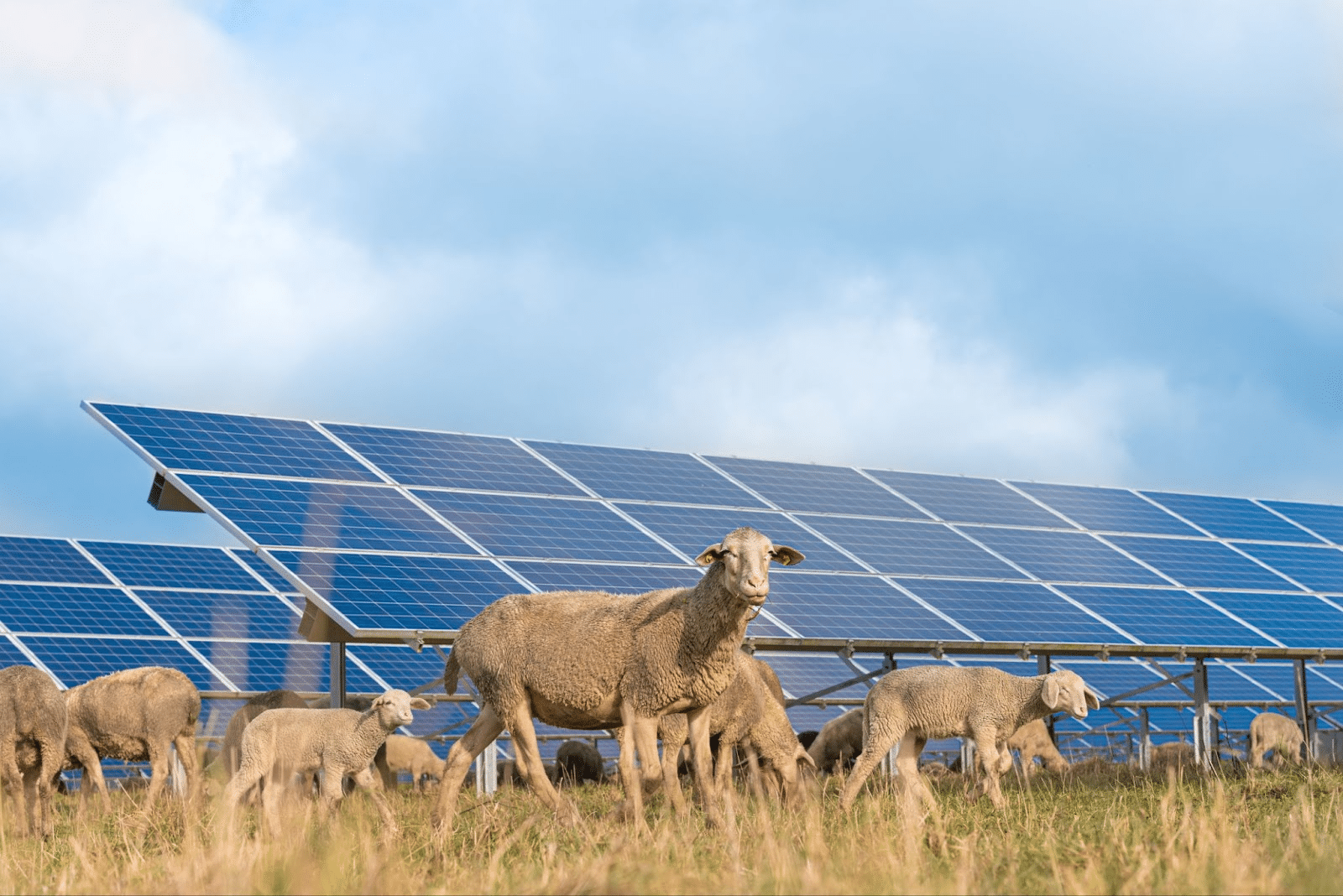

Examining ESG metrics in the context of utility-scale solar projects shows how sustainability and investment value often move hand in hand.

Environmental Metrics

Utility-scale solar projects deliver environmental benefits in ways that are both quantifiable and significant. Solar PV’s life-cycle greenhouse gas emissions are very low — NREL estimates indicate emissions in the tens of grams of CO₂ equivalent per kWh when considering total embodied and operational emissions for PV. When solar displaces fossil generation (e.g., coal, natural gas), avoided emissions can be substantial, especially in regions with carbon-intensive grids.

Water use for solar PV is also minimal compared to other energy plants. In a study of 34 large solar projects (~8.7 GW total capacity) in the U.S. West, the average water intensity was about 228 gallons per MWh under current deployment practices. More conservative estimates show utility-scale PV water consumption closer to 0–33 gallons per MWh, depending on climate, cleaning practices, and technology. By contrast, coal, nuclear, and other thermoelectric plants may consume many times more water per MWh, especially under wet cooling regimes.

Utility-scale solar farms increasingly use land efficiently. In Virginia, the average “disturbed acreage” per installed megawatt (AC) is about 6.93 acres/MW. SEIA guidance similarly estimates 5–7 acres per MW required for solar plants including full site infrastructure.

These land-use metrics translate financially: lower land costs and simpler permitting in lower-acreage sites can reduce development and ongoing risk.

Social Metrics

Solar development delivers strong local economic benefits. For instance, ground-mounted solar in Illinois generates $6,000–$8,000 per MW per year in property taxes paid to local taxing bodies. A large utility-scale project like the 800 MW Oak Run project in Ohio is expected to produce over $500 million in tax revenue over its lifespan and employ more than 3,000 workers during construction. While smaller in scale, utility-scale solar creates about 2.1 jobs per MW installed, versus nearly 19 for commercial solar or ~27 jobs/MW for residential and small-scale systems. These figures help explain why local investment, job creation, and tax revenue are often strong incentives for host communities, expediting permitting and reducing social risk.

Governance Metrics

Governance remains critical in reducing project risk and securing financing. Though specific quantitative governance metrics are less frequently published, developers and financiers consistently rely on standards like independent engineering reviews, environmental and social impact assessments, and transparent stakeholder engagement. These practices are often required by lenders and regulators, and help ensure that project assumptions (e.g. generation, environmental impacts, community effects) are validated, feedback is incorporated, and risk of delays or opposition is reduced. Precise data on how often these tools are deployed is mixed, but their role in due diligence and contracting is widely recognized.

Bottom Line

For investors, utility-scale solar illustrates that robust ESG metrics are not abstract — land use efficiency, community employment, and governance practices directly affect development costs, risk, and long-term project viability.

Conclusion

ESG metrics provide essential structure for evaluating factors that traditional financial analysis might overlook but that significantly influence long-term investment outcomes. Understanding what ESG metrics measure, how they’re calculated, and their limitations enables more informed investment decisions. No metric is perfect, and no framework captures everything. However, when used appropriately, ESG metrics can help identify potential risks before they become losses and potential opportunities before they become obvious.

In renewable energy, particularly utility-scale solar, ESG metrics often align naturally with business success. Projects that efficiently use land, meaningfully benefit communities, and maintain transparent governance typically achieve faster development, better financing terms, and smoother operations. This alignment makes solar an attractive option for investors seeking strong returns without sacrificing ESG performance.

For investors ready to see how ESG metrics translate into real investment opportunities, Shasta Power specializes in developing utility-scale solar projects that excel across all three ESG dimensions. Our projects undergo rigorous environmental assessment, prioritize community engagement, and maintain institutional-grade governance standards while targeting competitive returns. Connect with Shasta Power to explore how ESG-aligned solar investments can strengthen your portfolio while contributing to the clean energy transition.