POSTED

January 25, 2025

From Dollars to Difference: Impact Investing in Solar for Social and Environmental Good

Climate change is one of the most pressing issues of our era, and where you choose to invest can make a big difference. Directing funds toward solar ventures is more than an economic choice–It's a deliberate move toward a sustainable future. Turning resources toward solar power can generate financial returns while fostering healthier communities and a more stable environment.

What Is Impact Investing?

Impact investing represents a departure from conventional portfolios. Rather than focusing solely on profit, it incorporates the idea that investments should produce measurable benefits for people and the planet. This approach combines financial performance with social and environmental outcomes.

SRI (Sustainable, Responsible, and Impact)

Impact investing started with SRI, often known as Socially Responsible Investing, centered on excluding harmful industries. Over time, SRI broadened its focus, evolving into a more comprehensive approach that includes proactive strategies. Investors may screen out polluters or human rights violators and then seek opportunities that align with their ethical standards.

ESG (Environmental, Social, and Governance)

ESG represents a framework that evaluates a company’s performance in environmental stewardship, social responsibility, and governance practices. This model rose to prominence as investors recognized that good corporate citizenship often aligns with long-term financial health.

The Triple Bottom Line

Investing through the lens of the triple bottom line means measuring success against three metrics: profit, people, and planet. This concept shifts the conversation beyond short-term gains and encourages a more holistic understanding of value creation.

Key Principles of Impact Investing

There are a few key principles when it comes to impact investing.

Defining Goals and Intentionality

To genuinely invest for impact, it is vital to state your objectives from the start. Investors should articulate what social or environmental changes they expect to create. Intentionality is not a side note; it forms the core of a meaningful investment philosophy.

Financial Returns

While impact investing promotes social and environmental improvements, financial viability still matters. Many impact investments produce earnings that resemble those of traditional assets. In some cases, capital is at least preserved.

Measuring and Reporting Results

One hallmark of impact investing is accountability. Investors track and disclose environmental and social effects to verify that their actions lead to tangible benefits. Transparent reporting guides adjustments over time and maintains investor confidence.

Environmental Benefits of Utility-Scale Solar Power

Utility-scale solar energy can replace traditional power sources like coal, natural gas, and oil. Fossil fuel combustion emits large amounts of greenhouse gases. In fact, coal plants alone can release over 2,000 pounds of CO₂ per MWh. Solar arrays, by contrast, produce electricity without emitting greenhouse gases during operation. Lifecycle emissions for solar hover around 95 pounds per MWh, a fraction of those of fossil fuels. Solar panels also offset their production emissions within a few years and then generate carbon-free electricity for decades.

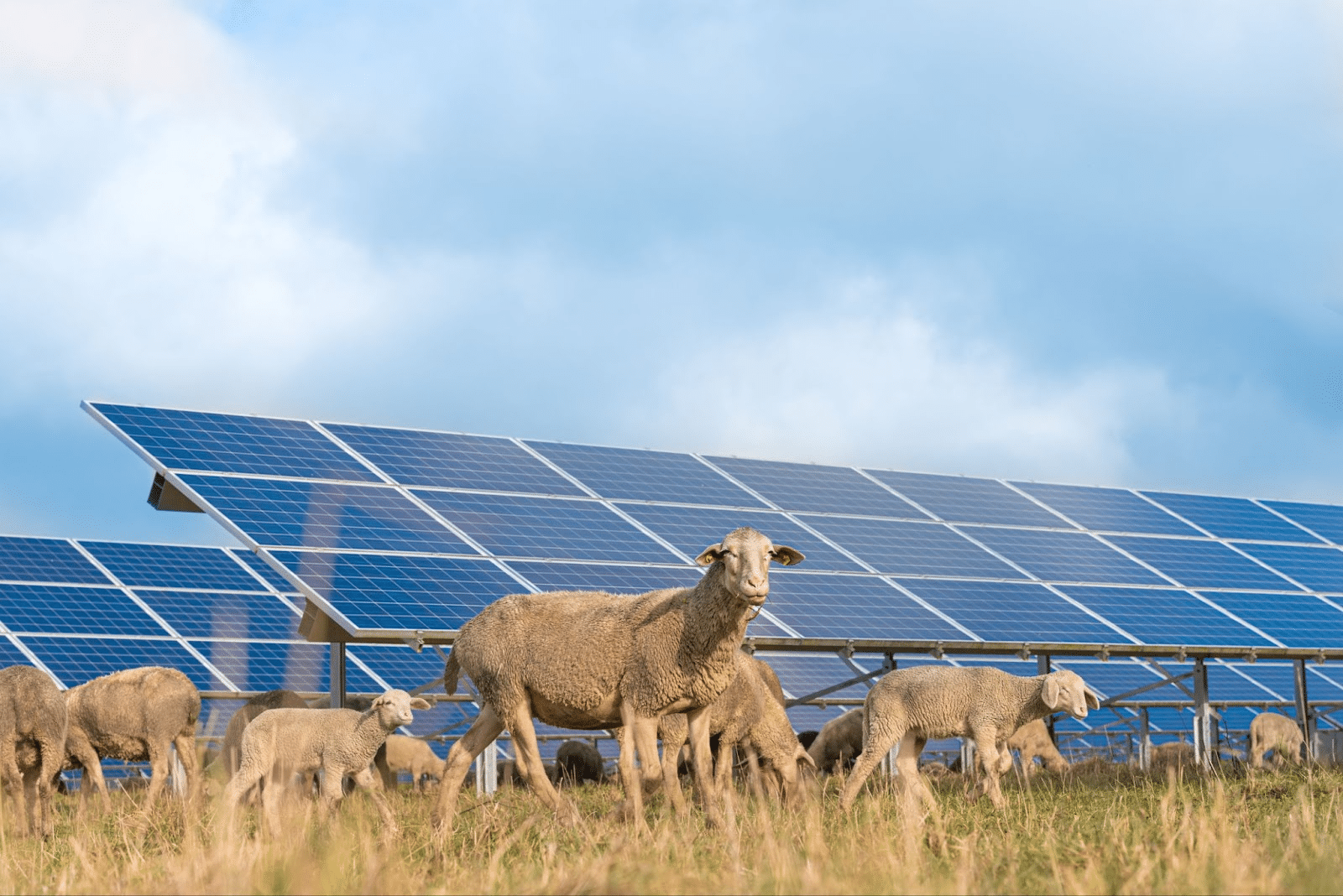

Some solar farms incorporate native vegetation, including wildflowers and grasses, to encourage pollinator habitats. Enhancing biodiversity helps nearby fields become more productive. Integrating agriculture with solar production, often called agrivoltaics, allows crops or livestock to coexist with energy generation. This model preserves farmland while producing renewable electricity.

Social Benefits of Utility-Scale Solar Power

Building and maintaining large solar sites can provide substantial employment opportunities. Construction and installation activities stretch across many months, and numerous workers find steady jobs.

Installing solar facilities also often requires upgrading roads, substations, and transmission lines. These enhancements can bolster the resilience of local grids. Communities that host solar operations frequently benefit from increased spending by construction crews and long-term staff. Moreover, solar installations can increase property and sales tax revenues supporting public services.

Financial Benefits of Utility-Scale Solar Investments

Power Purchase Agreements (PPAs) provide predictable earnings by locking in electricity prices for long durations, often 10 to 25 years. Legislation like the Inflation Reduction Act (IRA) also extends tax credits and other incentives for solar projects. The Solar Investment Tax Credit and the Production Tax Credit encourage affordable solar development.

Internal rates of return on large solar projects often range from 5% to 8%. For a $100 million initiative, that could amount to several million dollars of revenue over time.

How to Get Started with Shasta Power

Shasta Power specializes in sourcing and developing large-scale solar farms, using private funding to bring projects from initial concept through construction and operation. Our team selects sites based on solar availability, grid access, and ecological considerations. We handle permitting, engineering, and construction with great care. For investors, we present an opportunity to support cleaner energy while pursuing attractive returns.

Our Summit Power Fund typically targets internal rates of returns above 20% over its lifespan. We have a proven track record, and we invite interested parties to learn more by contacting us directly. Public details are limited due to the sensitive nature of our projects, but additional documentation is available after completing an NDA.

We also make investing easy. Contact us to create an account. After that, we’ll verify your eligibility to invest. Then you’ll sign our subscription agreement and transfer your investment. We anticipate opening our SPF II fund by early 2025. More details are available at Shasta Power.

Impact investing in solar aligns financial interests with a cleaner future. Utility-scale solar projects reduce greenhouse gases, protect biodiversity, support jobs, and boost local economies. Renewables have emerged as a key element of sustainable growth, and investors have a critical role in guiding this transformation. Consider how your capital decisions will resonate across generations.

If you are ready to take the next step, contact us for more information. Our team can guide you through the investment process and help you understand how utility-scale solar can be part of your financial journey and environmental commitment.