POSTED

March 28, 2025

Solar Loans vs. Solar Land Leases: Which is Right for Your Property?

Large-scale solar development is an appealing option for landowners looking for a new source of revenue. But, in order to develop your land, you need a way to finance the project. Many landowners struggle to decide between financing their own solar project or leasing their acreage to a developer. Each approach has different financial structures, responsibilities, and outcomes. This post looks at the pros and cons of each approach. By the end, you’ll have a clearer picture of which route suits your goals best.

The Basics of Solar Financing

From small residential installations to large solar farms, solar projects require some kind of financing. Two common approaches are solar loans and solar land leases.

Solar Loans

A solar loan works a lot like a home improvement loan, but instead of upgrading a kitchen or bathroom, you’re financing solar panels. With this option, you own the system outright once you pay off the loan. That means you can take advantage of tax incentives and long-term energy savings.

Loan terms typically range from five to 25 years, giving borrowers flexibility in structuring payments. Shorter terms often come with higher monthly payments but lower interest costs. Longer terms reduce monthly payments but may lead to more interest paid over time. During the loan period, your home or land will have a lien on the title, so if you sell the property, that lien will be paid back during the closing process.

Because you eventually own the system, you aren’t tied to a third-party company for maintenance or performance guarantees. You also might benefit from any increase in land value. Many lenders, including banks, credit unions, and specialized solar financing companies, offer solar loans. Interest rates and terms vary based on credit scores, loan types, and lender policies.

Solar Land Leases

Solar land leases provide property owners with a steady long-term income stream by allowing developers to install and maintain solar panels on their land. Unlike traditional farming or commercial development, solar leasing requires no upfront investment or maintenance costs from the landowner, making it an attractive, low-risk option. . These agreements typically span 20 to 40 years, ensuring decades of reliable revenue while allowing landowners to retain ownership. Payment structures vary, with some contracts involving fixed quarterly payments, while others pay out in annual lump sums.

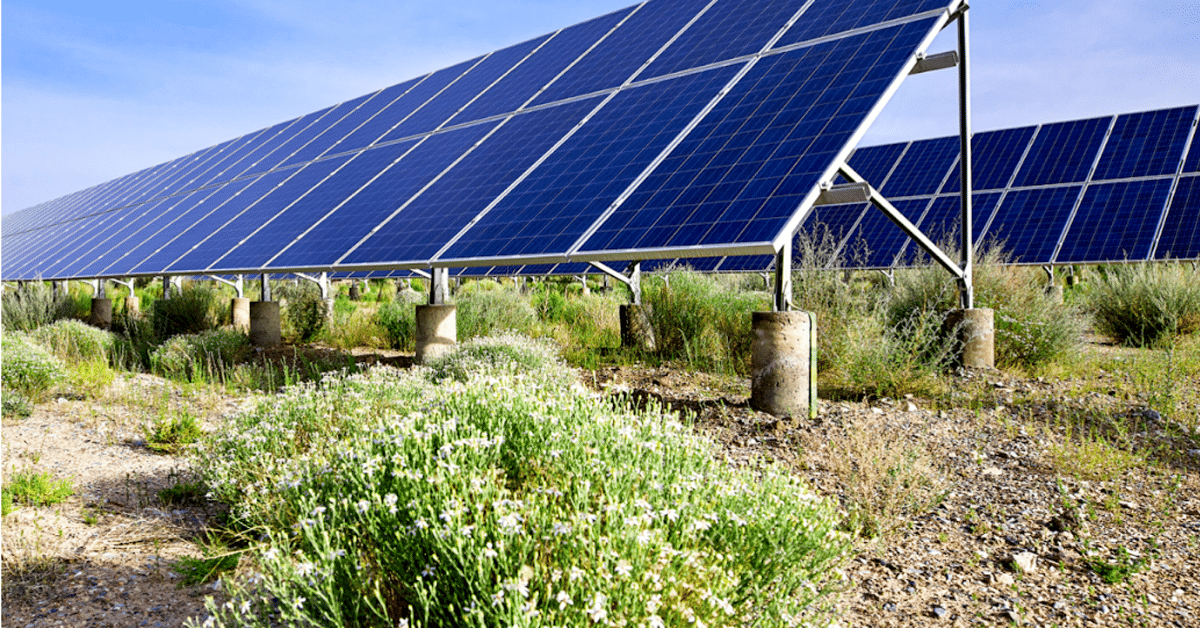

Additionally, solar leases can often be structured to accommodate continued agricultural use, such as sheep grazing or pollinator habitats, allowing for dual land use that benefits both the environment and the local economy.

For many landowners, leasing to a solar developer is a low-risk way to put underutilized acreage to work. Unlike selling land outright, a solar lease preserves ownership rights, and it can provide consistent revenue for future generations.

Pros and Cons of Solar Loans

Solar loans offer a path to ownership, often leading to greater long-term savings than leasing. Landowners can tap into federal and state incentives to help offset initial costs, making solar more affordable over time. Ownership also provides full control over system design, installation, and energy production. Once the loan is paid off, the system generates electricity without additional costs, reducing utility bills for years to come.

However, taking out a loan means covering upfront expenses, including installation and possible upgrades. Large scale solar farms can cost in the many millions, making bigger developments out of reach of many landowners. Monthly payments can limit early savings, especially if interest rates are high. Maintenance and repairs also fall on the owner, adding potential risks from costs and responsibilities. Unlike lease agreements, solar loans don’t include built-in support for troubleshooting, which means handling system issues independently.

Pros and Cons of Solar Land Leases

A solar land lease provides a steady income stream with little effort from the landowner. The developer handles all costs, including installation, permitting, and ongoing maintenance. This setup allows you to generate revenue without actively managing the installation, making it an attractive option for those looking to put unused land to work without taking on financial risk.

However, these agreements often last for decades, limiting future land use options. Lease terms are typically fixed, offering little flexibility once the developer signs the contract. Additionally, developers retain control over project decisions, leaving landowners with less influence over how the land is used during the lease period. While leasing can be a smart financial move, weighing these trade-offs before making a long-term commitment is important.

Shasta Power’s Approach

Our process begins with an initial discussion. During this conversation, we review the location, size, and suitability of the land for a potential project.

Following the initial discussion, our team will conduct a thorough assessment to determine whether the property meets the requirements for solar installation. This includes evaluating topography, soil conditions, and any existing structures. We utilize advanced tools to measure sunlight exposure and estimate energy production potential. Additionally, we assess the property’s proximity to transmission lines and substations, which are essential for connecting the solar farm to the power grid. Environmental and zoning regulations are also reviewed to identify any issues that may impact the development process.

If the land meets the necessary criteria, we present a lease agreement outlining the terms. The agreement specifies how the land will be utilized. We can also explore dual-use options, like integrating livestock grazing beneath the solar panels to maximize the land’s productivity.

Overcoming Challenges with Shasta Power

Shasta Power has a deep knowledge of land assessment and solar project development. Our team handles the full evaluation process to determine if your land meets the necessary requirements. From your first inquiry to the point where your lease is active, we guide you through each step.

We also develop clear and transparent lease agreements. We structure contracts with easy-to-understand terms and payment schedules. With Shasta, you’ll always know what to expect when it comes to your income.

Solar projects work best when communities are informed and involved. We take a proactive approach, maintaining open communication with local stakeholders to build support and address concerns early in the process.

Choosing between a solar loan and a land lease comes down to your long-term goals, financial situation, and level of involvement. If you want ownership, tax incentives, and full control over your system, financing a solar project might be the right fit. If a steady income without upfront costs or maintenance responsibilities sounds better, leasing your land to a developer could be the smarter choice.

Both paths offer unique advantages, but the right decision depends on how you want to use your property and manage your investment. At Shasta Power, we help landowners explore their options and find the best approach for their needs.

If you’re considering leasing your property for solar energy, take the next step by contacting us. A brief conversation may open the door to stable revenue and a valuable contribution to the renewable energy era.