POSTED

July 27, 2023

3 Things to Consider Before Investing in Renewable Energy

With the rise of sustainability and environmental consciousness, renewable energy investments can be quite profitable. It’s easy to jump on the solar bandwagon (and we think you should) but it’s also important to know the facts for yourself for why solar is an attractive investment opportunity. There are many renewable energy investment options for accredited […]

With the rise of sustainability and environmental consciousness, renewable energy investments can be quite profitable. It’s easy to jump on the solar bandwagon (and we think you should) but it’s also important to know the facts for yourself for why solar is an attractive investment opportunity.

There are many renewable energy investment options for accredited investors. From investing in individual stocks to funds and EFTs, you want to ensure that the investment option you choose will get you as much return on investment (ROI) as possible.

So, what should you know about these energy sources before you commit your own capital to them? Let’s talk about three top things you should know.

1. Solar energy investment is on the rise

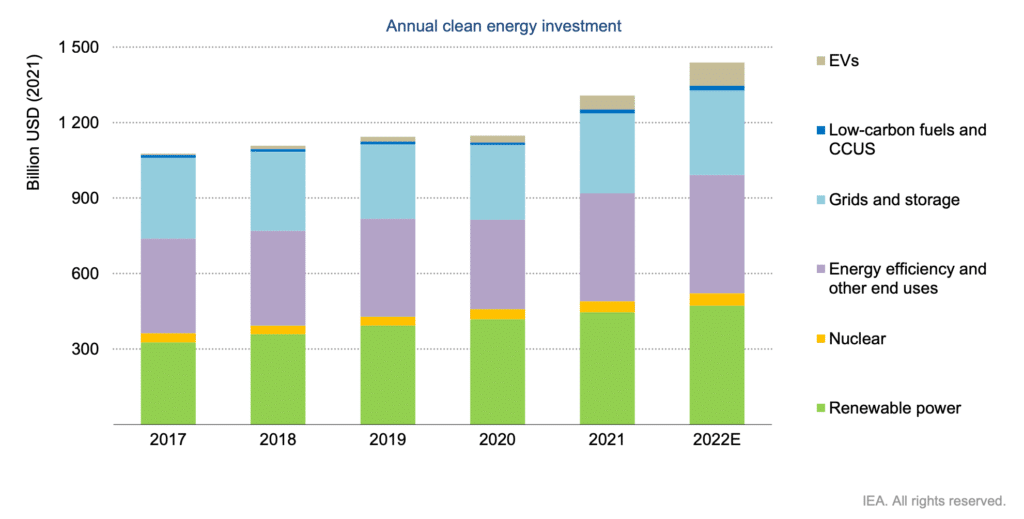

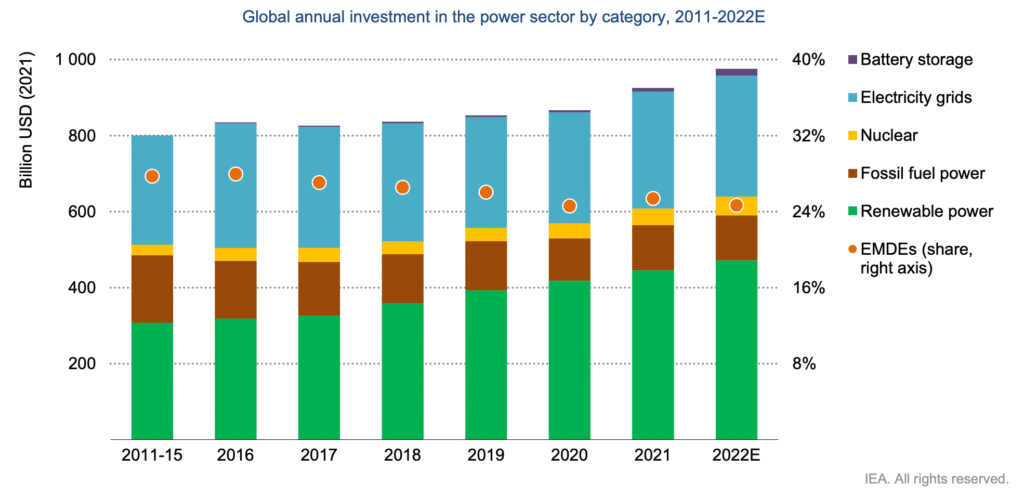

The 2022 International Energy Agency (IEA) report on World Energy Investment examined the full spectrum of energy issues and found some interesting insights regarding renewable energy investments. Let’s take a look at some charts.

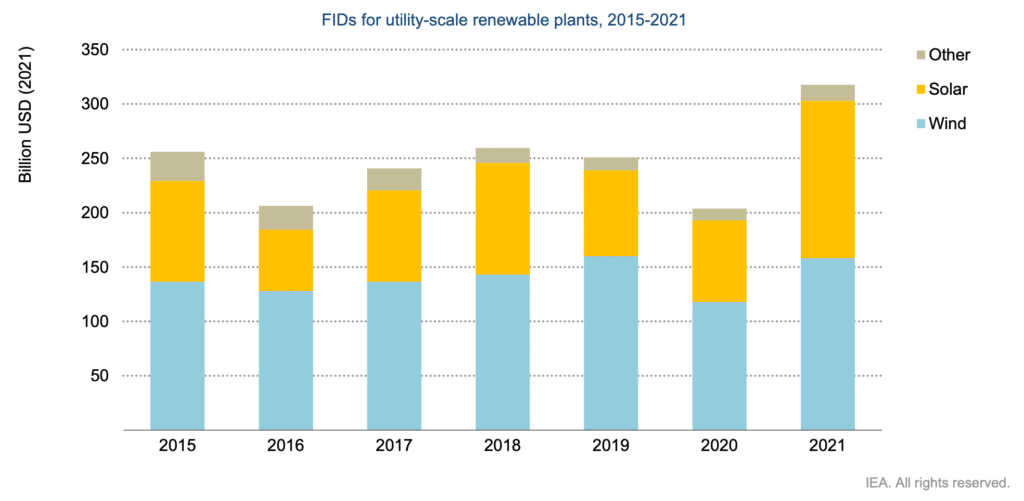

Today, most green energy investments today are focused on wind and solar. We also see that of the clean energy investments, Solar Photovoltaics (PV) is leading the way.

In 2021, Final investment decisions (FIDs) for utility-scale renewables hit new records with a significant jump in solar projects.

What’s the takeaway? Renewable energy investments are on the rise, and utility-scale solar is leading the movement. If you want to invest in renewable energy, solar is a great place to start.

2. There are various ways to invest in renewable energy

You have several options for investing in renewable energy. You can read more about them in our blog post, How to Invest in Utility-Scale Solar Energy, but let’s briefly look at each one.

Private Equity Fund

What is a private equity fund? Our Summit Power Fund at Shasta Power is a great example. It is a group of accredited investors that band together and place their money in one fund.

This fund then provides money to develop solar power generation facilities that provide energy to the electric grid. In turn, these large, utility-scale solar plants generate lots of power and lots of return.

Renewable Energy Stocks

Renewable energy stocks are individual companies that are traded on the public market. They offeru a more generic way of investing in solar.

ESG (Environmental, Social, and Governance) Mutual Funds

Short for Environmental, Social, and Governance, ESG mutual funds are investments that are evaluated based on criteria that assess sustainability. These funds only invest in companies that care about their impact, and are conscious of their sustainability such as making sure they leave limited pollution or diversify their leadership.

Clean Energy Exchange-traded Fund (ETF)

What is a clean energy ETF? This type of fund is an exchange-traded fund that invests specifically in clean energy progress.

You should note that if you opt for a mutual fund or ETF, you might be investing in traditional energy companies as well.

3. Natural energy carries natural risk

Renewable energy has many multiple advantages over fossil fuels but there are risks to consider, particularly for accredited investors who are new to ESG investing.

Here are some common risks when investing in renewable energy systems compared to traditional fuel sources:

- Renewable energy has a high-cost upfront

- Renewable energy is not steady

- Renewable energy has limited storage capacities

- Renewable energy sources have geographic limitations

- Renewable energy is not 100% carbon-free

However, as any investor knows… risk almost always comes with a reward! Putting your dollars toward a sustainable future of renewable energy is an investment that has incredible potential to create a worthwhile legacy.

Invest directly in solar through Shasta Power

Are you ready to invest your capital into a clean future? Watch a free webinar from Shasta Power partners Max and John to learn more about renewable energy and why it is a powerful place to invest your investment funds.