POSTED

May 10, 2024

Read 5 Benefits to Adding Utility-scale Solar Farm to Your Investment Portfolio

In today’s investment world, traditional options don’t always meet the mark for conscious investors: making money and helping the environment. Accredited and ESG investors are looking for something different. They want something that brings profit and does good for the planet. But what are their choices? Conventional markets might seem safe, but they often don’t […]

In today’s investment world, traditional options don’t always meet the mark for conscious investors: making money and helping the environment. Accredited and ESG investors are looking for something different. They want something that brings profit and does good for the planet. But what are their choices? Conventional markets might seem safe, but they often don’t do enough for both money and the Earth. That’s where utility-scale solar farms come in—they’re the unsung heroes of clean energy investing.

In this article, we’ll look at why traditional investments fall short, why solar farms shine bright, and why adding them to your investment portfolio is a smart move. We’ll explore five big reasons why jumping into solar energy investing isn’t just smart financially but also a big step towards a greener future.

Understanding Utility-scale Solar Farms

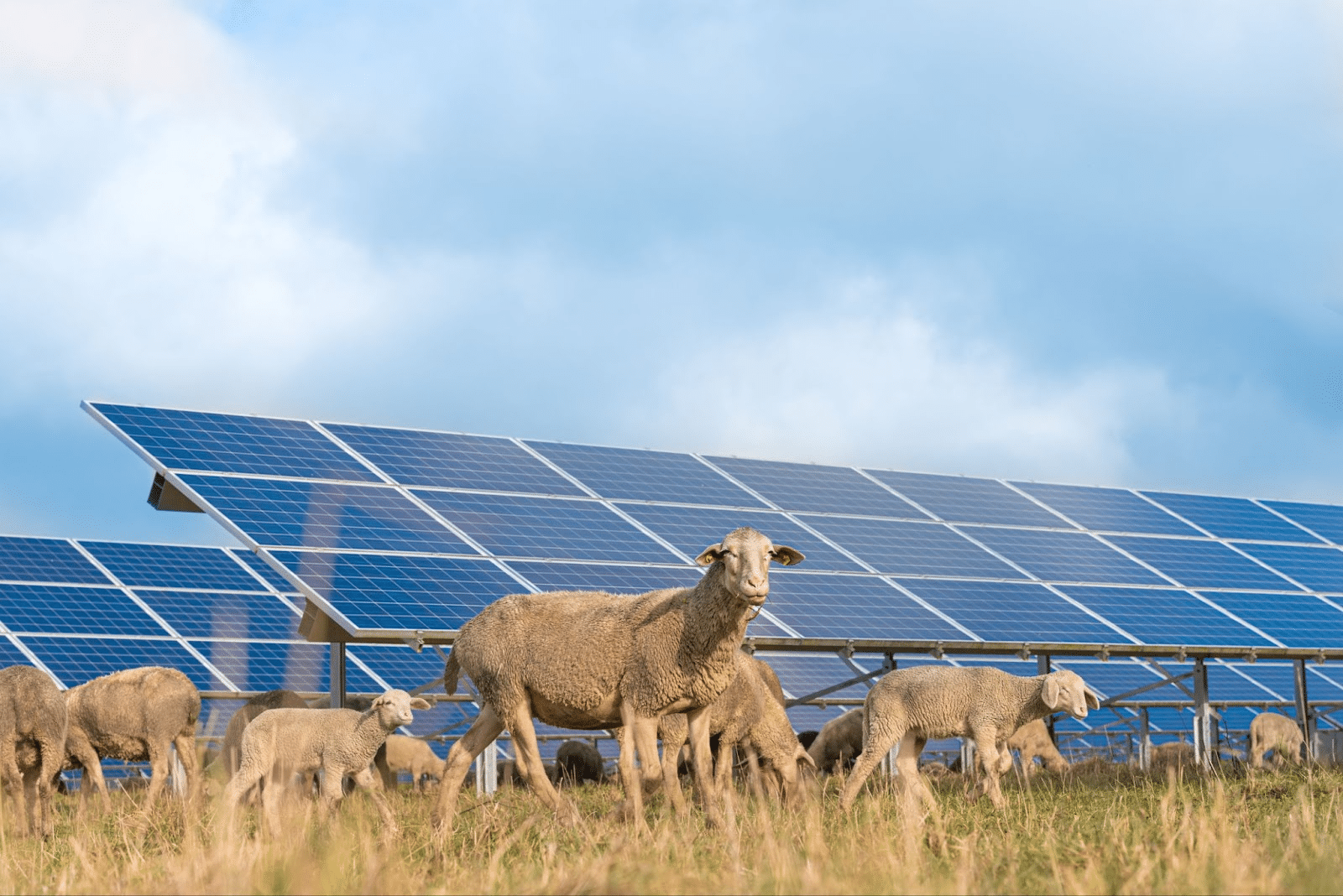

Utility-scale solar farms are large projects that make electricity from sunlight. They have parts like solar panels, inverters, transformers, and substations. Solar panels catch sunlight and turn it into electricity using something called the photovoltaic effect. Inverters then change the electricity into a type that can power homes and businesses.

- Size and Scale: These solar farms are much bigger than the ones you might see on roofs or small areas near buildings. They cover a lot of land, sometimes thousands of acres. Because they’re so big, they can make a ton of electricity—enough to power entire towns or even whole cities.

- Operational Dynamics: Utility-scale solar farms go through different stages. First, they research potential sites for feasibility. Next, they pick a location and option the land to lease or buy it. Then they work to. get permission from the permitting authorities to build there. Finally, they start building the farm. After they’re built, solar farm operators have to keep the farm running smoothly with regular monitoring and maintenance. After 35 or 40 years of smooth operation, they decommission the solar farm; essentially, take everything apart and return the land to how it was before.

- Market Dynamics: Renewable energy, like solar power, is becoming more popular. People want cleaner energy, and solar tech is getting cheaper. Governments and businesses are investing in solar power to cut down on pollution and meet environmental goals.

- Market Trends: Solar technology is constantly improving. Panels are becoming more efficient, and we’re finding new ways to store solar energy. More countries are starting to use solar power, especially in places where it’s sunny. Solar power is also sometimes combined with other renewable sources like wind and hydroelectric power.

- Regulatory Environment: Governments have rules and programs to help solar farms. These can include tax breaks, laws that mandate how much renewable energy a place has to use, and programs that let solar farms sell credits for the clean energy they make.

- Investment and Revenue Potential: Investing in solar farms can make a lot of money from selling electricity. In addition, solar farms can get money from tax breaks and selling credits for clean energy. These extra ways of making money help make investments in solar farms more attractive.

- Financial Performance: Solar farm investors look carefully at their return on investment ‘ROI’ , the investment period (how long it takes to get their money back), and how much they’ll make overall. They use solar farm modeling systems, to make predictions about electricity generation, revenues, and costs, to determine if it’s a good investment.

1. Financial Risks

Before diving into solar energy investments, it’s crucial to understand how much money you can expect to make. Shasta Power makes money by originating solar farms and selling those assets to Independent Power Producers (IPPs). To understand the timeline for returns better, check out our article How To Predict When You’ll Get Paid From A Commercial-Grade Solar Investment.

Investing in solar energy isn’t without risks. Changes in laws, shifts in energy prices, or problems with project management can affect returns. Shasta Power works to reduce risks by being careful, spreading investments across different projects, and partnering with reliable companies.

Comparative Analysis

Compared to traditional public investments, private solar energy investing has the potential to offer better returns. While traditional public investments may be steady, private solar investments have the potential for higher profits. Plus, there’s the added bonus of helping the environment.

Solar investments can be a smart move because they’re less affected by market ups and downs. Unlike other investments that may be shaky during uncertain times, solar energy tends to be more stable. However, starting new projects still carries risks, so it’s important to be cautious.

Portfolio Performance

Including solar energy in an investment portfolio can spread out risks and potentially boost overall performance. By mixing assets with different levels of risk and ways of making money, investors can manage risk better and possibly earn more. Solar investments not only make financial sense but also contribute to a cleaner planet.

2. Hedge Against Inflation

Understanding how solar energy relates to inflation is key. When prices go up across the board, including for goods and services, it affects everyone’s purchasing power.

Inflationary Hedge

Solar energy investments can act as a shield against inflation. As prices rise, the value of solar energy also goes up. This offers a way to protect against losing purchasing power. It’s essential to note that this doesn’t mean there’s no risk involved.

Looking back at history, we can see how solar energy has performed during times of inflation. It’s shown resilience, holding its value even when other investments struggle.

Portfolio Resilience

Including solar energy assets in a portfolio helps protect wealth from losing value over time due to inflation. By diversifying with solar, investors can safeguard their purchasing power.

Solar farm properties tend to increase in value during times of inflation. Investing in them now could mean capitalizing on their potential for growth as prices rise.

3. Low Maintenance for Hands-off Investment Approach

Investing in solar farms is easy because they don’t need much upkeep. Once they’re up and running, they keep making money with predictable effort and costs.

Short-term Income Generation

Professional companies take care of the day-to-day work of running solar farms. They handle everything so you can enjoy the benefits of solar energy investments without any stress. Solar energy projects can help you make money without having to actively manage them. This means you can earn extra cash without a lot of work.

Investor Experience

Shasta Power provides resources to help investors understand how they can make money from solar energy investments. With their help, investors can make smart decisions and get the most out of their investments.

Shasta Power is dedicated to helping investors every step of the way. Whether answering questions or providing support, they’re dedicated to providing a great experience.

4. Environmental and Social Impact

Shasta Power aims to make investments that are good for the environment, society, and business. While no outside group oversees this, Shasta Power considers these factors when making decisions.

Environmental Sustainability

Solar energy investments help the environment by reducing pollution and cutting down on carbon emissions. This makes them a key part of efforts to keep our planet healthy.

Solar farms not only create clean energy but also bring benefits to communities. They create jobs, boost local economies, and provide clean energy access, improving people’s lives.

Stakeholder Engagement

Shasta Power works with others, like environmental groups, farm neighbors, local contractors and communities, to achieve their goals. By collaborating with different groups, they aim to make positive changes in society and the environment.

Shasta Power believes in doing business in a fair and ethical way. By following strict standards, they aim to have a positive impact on both society and the environment.

5. Portfolio Diversification and Risk Mitigation

Solar energy investments can help diversify and manage risks in investment portfolios. Investors can spread out risk and potentially increase returns by including solar alongside traditional investments.

Asset Allocation Models

Designing portfolios that mix solar energy assets with other investments is important. This helps create balanced portfolios that can weather market ups and downs. Working with a licensed money manager to ensure investors know risks, is always advisable.

Balancing risks and returns is key to long-term financial success. Solar energy investments offer opportunities for growth while managing risks, leading to better overall wealth preservation.

Taking advantage of solar energy opportunities in different places and project types is important. This helps reduce the risk of relying too heavily on one area or type of investment.

Sector Exposure

Investing in renewable energy, including solar, can potentially offer better returns with lower risk compared to traditional investments. By looking beyond traditional investments, investors can enhance their returns while managing risks.

There are different ways to invest in solar energy, such as owning solar farms directly and investing in funds. Each option offers its own benefits and risks, allowing investors to choose what works best for them.

Renewable Energy Projects Conclusion

Utility-scale solar farms are a great opportunity for accredited and ESG investors. They help diversify portfolios and make money while also helping the environment. With little upkeep needed and the potential for growth, solar energy investments offer a promising way to build wealth.

Now is the time for accredited and ESG investors to jump on the solar energy bandwagon. By investing in solar farms, they can make money and contribute to a cleaner planet. It’s a win-win opportunity that shouldn’t be missed. For those interested, exploring Shasta Power’s Summit Power Fund could be a great next step.

The future of solar energy looks bright. With new technology and government support, solar power is becoming a big part of our energy future. By investing in solar farms today, investors can be part of this exciting journey towards a more sustainable world.