POSTED

November 24, 2023

3 Types of Solar Farms for Investment

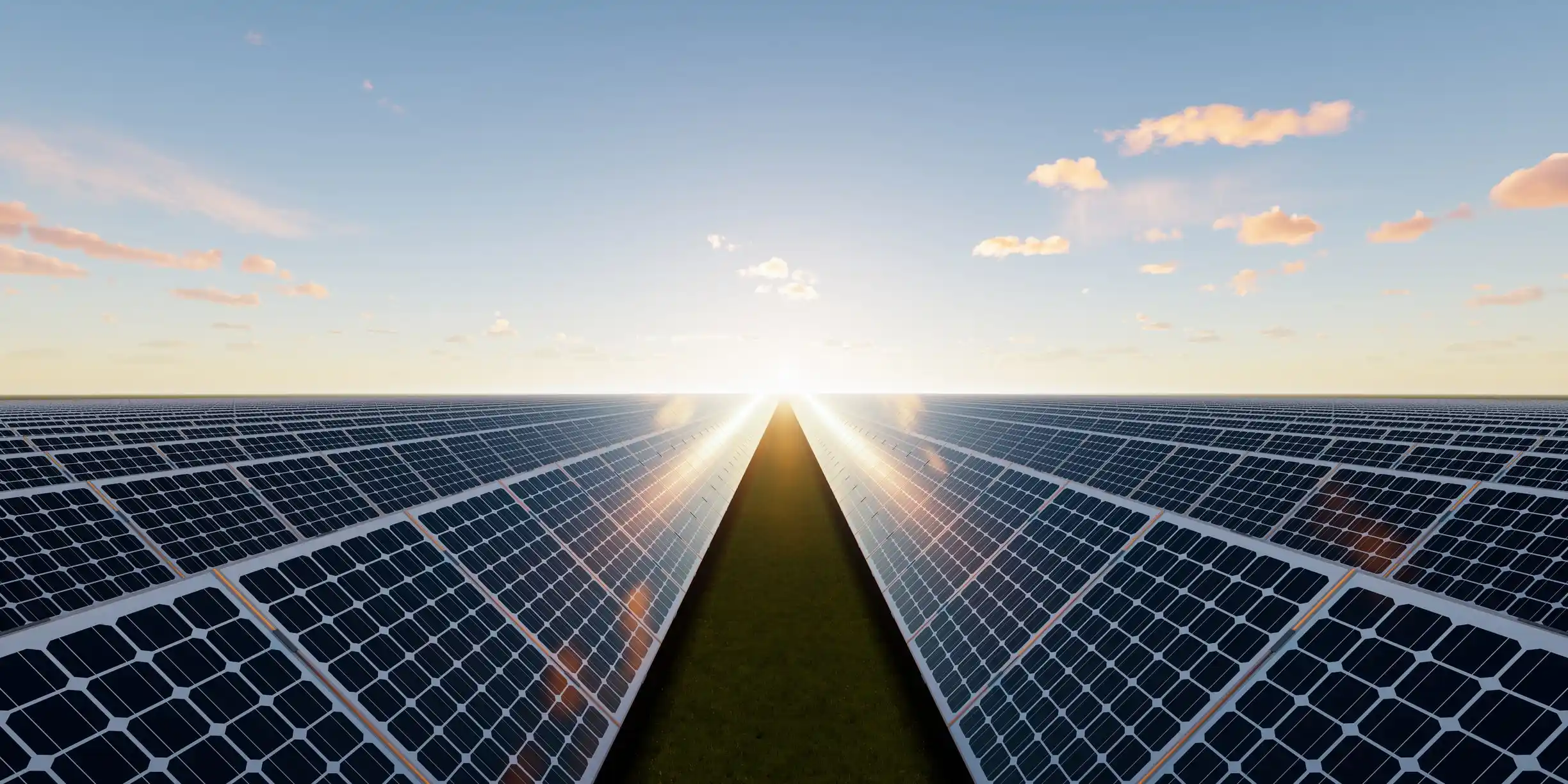

Investing in solar farms could be a game-changer for your finances and the environment! But you might be wondering what’s available regarding the different types of solar farms for investment. Solar farms are powerhouses; pun intended. They soak up the sun’s energy and sell it to power companies, transforming the world of energy sources. If […]

Investing in solar farms could be a game-changer for your finances and the environment! But you might be wondering what’s available regarding the different types of solar farms for investment.

Solar farms are powerhouses; pun intended. They soak up the sun’s energy and sell it to power companies, transforming the world of energy sources.

If you’ve followed the growing transition to solar power, you may wonder what type of solar farm would suit your investment needs best. In this article, we’ll break down three types of solar farms: utility-scale, microgrid, and community solar farms.

We’ll explore what they are, and how they could impact your investment. We’ll also cover some quick tips for deciding if you should invest in solar farms. They’re on the rise, and this blog post is your guide to the future of clean energy investing!

Why the Types of Solar Farms for Investment is relevant to you

The energy crisis is a real concern for anyone paying attention. In response to it, many homeowners have chosen to install solar panels to leverage renewable energy and save on rising personal energy costs. Others have chosen to help address the energy crisis at the root level by investing in a solar farm — and they benefit financially from those investments.

If you are considering investing in solar farms, it’s crucial for you to know about the different types of solar farms you can invest in. The world of solar farms and investing is evolving rapidly, and understanding your options is essential.

Wait, who is Shasta Power?

Since you’re reading this article on the Shasta Power website, you might be wondering, “Who exactly is Shasta Power? Why should I listen to them?”

We are a private equity firm connecting investors with utility-scale solar investment opportunities. While our solar farm investment opportunities through the Summit Power Fund require a minimum investment of $50,000, other options exist for future accredited investors who still want to invest.

Let’s look at those options through the lens of three different types of solar farms.

1. Utility-Scale Solar Farms

What Are They?

Utility-scale solar farms are giant power plants using the sun to generate electricity. They sell this energy to power companies, which, in turn, supply it to entire towns and cities.

Investing Impact

These farms are enormous and high-impact. They require significant upfront investment but also bring in significant amounts of profit over time. If you’re interested in the compelling option of investing in utility-scale solar farms, check out our article here for more details.

2. Microgrid Solar Farms

What Are They?

Microgrids are small-scale energy systems that are a step up from rooftop solar panel installations. Commercial and industrial facilities often utilize them. In some cases, a Microgrid Solar Farm and Commercial and Industrial Solar Farm are actually the same thing. Typically, their maximum capacity is fewer than 100 kilowatts (kW).

Investing Impact

Microgrids frequently use battery storage as a backup, often providing electricity to themselves or nearby communities during occasional power outages or grid failures. If there is a power outage, these microgrids work independently of the primary power grid. As smaller solar installations, microgrid solar farms only require a small initial investment (and therefore low risk) but usually bring in small returns.

3. Community Solar Farms

What Are They?

Community solar farms are accessible to everyone in a given neighborhood, allowing residents to invest in and use the clean energy generated. These farms are a type of distributed generation. They distribute it throughout a community instead of directly feeding power to a facility. Most community solar farms have a maximum capacity of two megawatts (MW).

Investing Impact

Community solar farms are a great way to support local clean energy. The profits typically range from $40,000 to $120,000 annually, and are shared equally among the homeowners who invest in the solar farm.

Should You Invest in a Solar Farm?

Let’s look at some tips to help you determine if solar farm investing aligns with your goals and budget:

1. Define Your Goals

Do you want steady, long-term income, or are more interested in potential higher returns with some risk? Make sure you know what your goals are.

2. Know Your Budget

How much are you willing to invest in a solar farm? Your investment should align with your financial goals and risk tolerance.

3. Talk to an Expert

A financial advisor or renewable energy investment expert can help tailor your strategy to your individual financial situation and goals.

Investing in solar farms is a wonderful opportunity if you are interested in renewable energy and financial growth. We’ve explored three types: utility-scale, microgrid, and community solar farms, each with unique benefits and considerations. Solar investing constantly evolves, and the choice ultimately depends on your investment goals and budget.

Invest with Shasta Power

If you’re interested in investing in solar farms, consider investing with us here at Shasta Power. Watch our webinar to learn more details about investment opportunities and grow your knowledge for your financial future.