POSTED

April 25, 2025

Market Volatility Investment Strategies: Why Utility-Scale Solar Offers a Stable Option

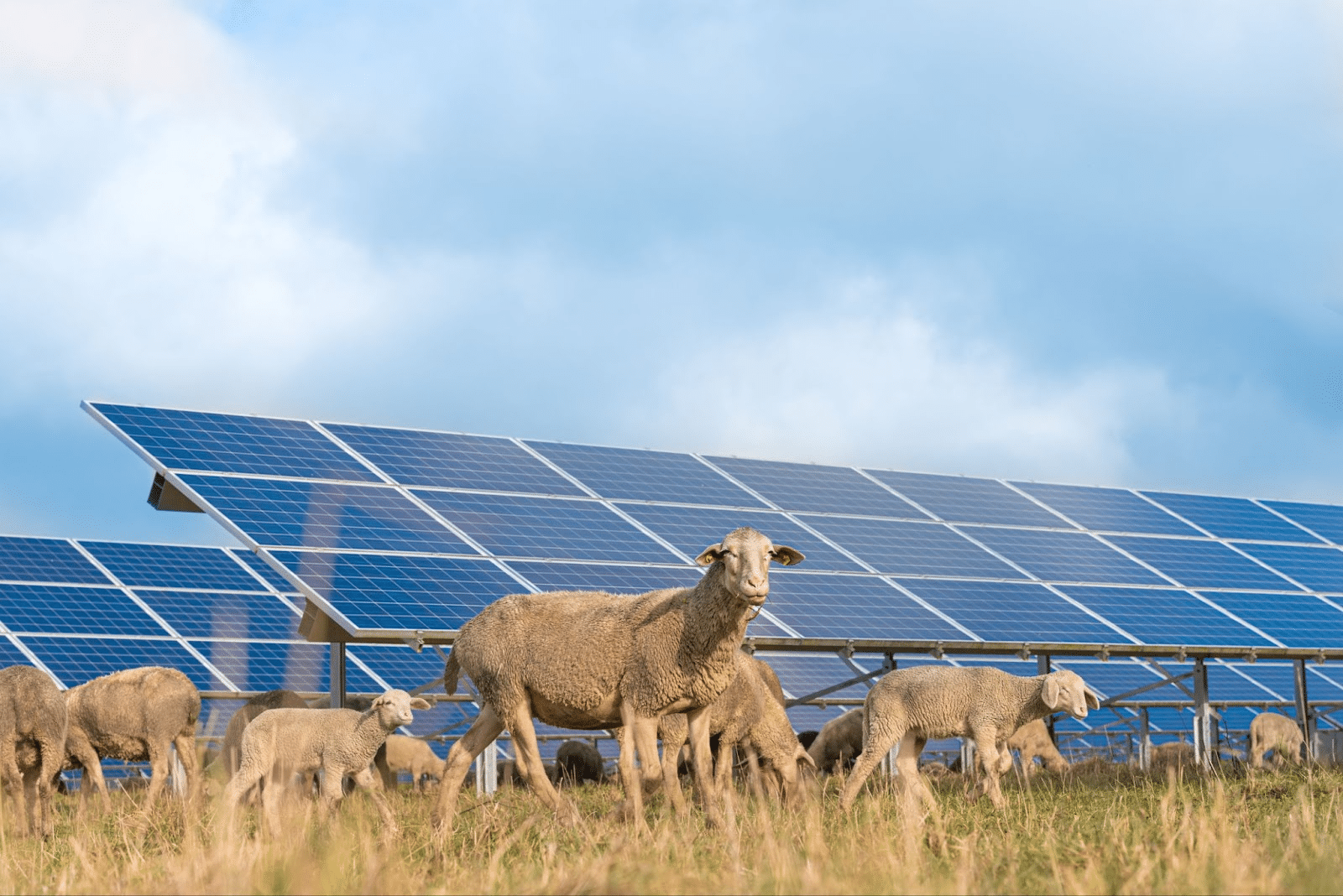

Utility-scale solar offers a stable, growth-oriented alternative to volatile public markets. Shasta Power develops solar projects, delivering investor returns through real asset value creation—not market speculation. With strong demand, clear project cycles & sustainability impact, it’s a resilient, future-focused strategy.

Public markets like the Dow Jones are known for long-term growth—but they’re also subject to short-term volatility. For investors looking to diversify beyond the stock market, utility-scale solar offers an alternative rooted in tangible assets, predictable development cycles, and rising demand for clean energy infrastructure. Market volatility investment strategies are crucial.

Rather than riding market cycles, solar development investments focus on creating value through the build-out of high-impact energy projects. With Shasta Power, that means identifying and developing solar farms—then partnering with long-term operators to manage for decades to come. It’s a model powered by people, built for the future, and rooted in real-world transformation.

Market Volatility Investment Strategies: Solar Development in Diversified Portfolios

In a world of market swings and economic uncertainty, many investors are looking beyond stocks and bonds. Solar development—specifically the acquisition, entitlement, and buildout of utility-scale solar farms—has emerged as a compelling alternative.

Unlike public equities, which rise and fall with headlines and sentiment, solar development is tied to real assets and defined project milestones. Investors participate in the value created as land is identified, entitled, engineered, and ultimately transferred to long-term operators. It’s a tangible, forward-moving process—not a bet on short-term market behavior.

This structure is appealing for a few key reasons:

- Non-correlated to public markets

- Grounded in physical infrastructure and energy demand

- A path to align capital with sustainability, without sacrificing return potential

As part of a diversified portfolio, solar development offers more than just resilience—it offers clarity. Investors know where value is being created, how progress is measured, and what drives outcomes. That clarity—paired with accelerating demand for clean energy—is why utility-scale solar development is gaining momentum with investors of all sizes.

Market Volatility Investment Strategies: Utility-Scale Solar Growth Opportunity

Solar isn’t just growing—it’s scaling. Driven by climate policy, declining technology costs, and surging demand for clean energy, utility-scale solar is becoming a central pillar of global energy infrastructure.

In the U.S. alone, the solar industry is projected to install more than 250 gigawatts of capacity between 2024 and 2029. That’s more than double the total capacity added in the previous decade. That growth is reinforced by long-term decarbonization targets, a maturing supply chain, and a strong policy backdrop—including tax credits and federal incentives designed to accelerate deployment.

Utility-scale solar development offers several advantages that make it especially attractive to investors:

- Built to scale. Larger projects reduce the cost per megawatt, streamline permitting, and make better use of labor and materials—improving margins and efficiency.

- High institutional demand. Power providers, corporations, and government entities are all under pressure to meet aggressive climate goals—and large solar projects help them get there.

- Predictable project cycles. Solar development typically follows a defined path: securing land, completing permitting and engineering, then transferring to long-term operators. Investors participate in a value chain that’s built around measurable progress.

At Shasta Power, we focus on capturing value during that development phase—where land is transformed into a high-value renewable energy asset. Instead of relying on long-term cash flow from power generation, our model returns capital when projects are transferred to independent power producers. It’s a shorter timeline, structured for momentum, and designed to meet the moment as utility-scale solar demand accelerates.

Globally, solar is now one of the most cost-effective sources of electricity, and it’s expected to remain so for decades. As infrastructure investment shifts toward clean energy, utility-scale solar stands out as a high-growth sector with long-term staying power.

What Investor Returns Look Like in Solar Development

Unlike traditional equity or bond investments, returns in solar development come from creating and delivering value—transforming raw land into fully permitted, utility-scale energy projects.

At Shasta Power, that value is realized when a developed project is transferred to an independent power producer (IPP). This structure is different from long-term infrastructure funds, which rely on cash flows over time. Here, investors participate in a defined development cycle—backed by hard assets, real project milestones, and growing market demand.

Target Returns

Solar development investments typically aim for an internal rate of return (IRR) between 12–20%, depending on project scale, timeline, and market conditions. These returns reflect the work of advancing land from initial acquisition through permitting, engineering, and pre-construction—not revenue from selling electricity.

Note: These figures are illustrative industry benchmarks and are not a projection of performance. All investments involve risk, and returns are not guaranteed.

Timeline

While timelines vary by region, most utility-scale solar development projects follow a 2–4 year lifecycle from land control to transfer. That allows investors to participate in renewable infrastructure without a decades-long holding period.

Where Shasta Power Fits In

Through its Summit Power Fund, Shasta aggregates investor capital to develop a portfolio of utility-scale solar projects across the U.S. SPF II—the next iteration of the fund—is currently in preparation, with a targeted launch in 2025. If you’d like to learn more or express early interest, you can join the waitlist here. When the offering becomes available, you’ll be among the first to receive updates and access the official offering circular.

Note: No money or other consideration is being solicited, and if sent in response, will not be accepted. No offer to buy securities in SPFII can be accepted and no part of the purchase price can be received until an offering statement filed with the SEC has been qualified.

The Impact Behind Market Volatility Investment Strategies

Investing in solar development isn’t just a financial decision—it’s a contribution to meaningful progress. Every utility-scale solar project that moves forward helps reduce our reliance on fossil fuels, lower emissions, and build a cleaner energy future.

The environmental impact is measurable:

- Less CO₂ per MWh: Fossil fuel power plants can release over 2,180 pounds of CO₂ per megawatt-hour. In contrast, the full life-cycle emissions of solar—including manufacturing and installation—range from just 22 to 75 pounds per MWh.

- Fewer Emissions per Acre: One acre of utility-scale solar can prevent the release of up to 436,000 pounds of carbon dioxide each year, depending on how dirty the local power grid is. That’s the amount of emissions avoided when solar replaces electricity from fossil fuels like coal or natural gas.

- Cleaner Air for Communities: By replacing fossil fuels, solar helps reduce the pollutants that contribute to asthma, heart disease, and smog. That means better air—and better health—for the communities where we build.

- Long-Term Clean Energy:

Solar panels typically recover their carbon footprint within 2 years, then continue to generate clean electricity for 30 years or more—delivering decades of environmental benefit from a single investment.

At Shasta Power, we view development as more than a technical process—it’s a chance to shape the energy landscape in ways that benefit people and the planet. Our approach is rooted in collaboration with landowners, engineers, communities, and investors who want to build something that lasts.

Why Shasta Power Is the Ideal Investment Partner

At Shasta Power, our focus is utility-scale solar projects that start with people—landowners, engineers, partners, and investors working together toward something bigger.

We handle the complexities—site evaluation, permitting, pre-construction—so our investors can focus on what matters: contributing to the clean energy transition while participating in a high-growth sector.

Shasta Power has a strong track record of delivering large-scale solar projects, optimizing for both sustainability and investor value. While transaction details remain private, additional information on past projects is available upon request under a non-disclosure agreement.

Market Volatility Investment Strategies: Learn More About SPF II

Our next fund, Shasta Power Fund II, will be launching soon. Built under Regulation A, SPF II will be open to both accredited and non-accredited investors.

Join the waitlist to receive early access to offering materials and updates as the fund moves forward.

Note: This is not an offer to sell or a solicitation to buy securities. Any investment in SPF II will be made only through official offering documents, once qualified by the SEC.