POSTED

December 13, 2024

Clean Energy, Clear Future: Rethinking Non-Renewable Energy Investments

Our investment choices today will shape the world we leave for future generations. In 2023, global emissions from fossil fuels reached a record high of 36.8 billion metric tons of CO₂, totaling an estimated 40.9 billion metric tons when including other sources. Climate change is also projected to cost the global economy up to $38 trillion annually by 2049, with estimates ranging between $19 trillion and $59 trillion.

Investors have a unique opportunity to drive the shift toward renewable energy. This article explores the benefits of renewable energy and how impact investing can create positive change.

The Environmental and Financial Risks of Non-Renewable Energy Investments

Investing in non-renewable energy sources like coal, oil, and gas presents growing environmental and financial challenges. As global awareness of climate change intensifies, the drawbacks of these investments become more pronounced.

Environmental Risks

Fossil fuels are the largest contributors to global climate change, accounting for over 75% of global greenhouse gas emissions and nearly 90% of all carbon dioxide emissions. Continued investment in this sector undermines efforts to limit global warming to below 2°C, as outlined in the Paris Agreement.

Divesting from fossil fuels sends a clear message that investors prioritize the planet’s health and future generations over short-term financial gains. Beyond emissions, fossil fuel extraction and combustion lead to air and water pollution. Hydraulic fracturing (fracking) releases harmful substances into water sources, while burning coal contributes to particulate pollution, impacting public health through respiratory diseases. Environmental degradation from these operations also threatens biodiversity and local ecosystems.

Financial Risks

The financial stability of fossil fuel investments is increasingly uncertain. Regulatory policies and global commitments are driving a shift toward decarbonization. Governments are setting stricter emissions targets, making fossil fuel investments vulnerable to restrictions and higher compliance costs. Consumers and investors are moving toward sustainable energy alternatives, intensifying financial pressure on fossil fuel industries.

Market volatility adds to these risks. Oil and gas prices are susceptible to geopolitical events and supply chain disruptions. There’s a declining profitability trend for fossil fuels as global demand for renewables rises. In 2023, fossil fuel stocks underperformed the market as a whole, with oil majors reporting a 30% decline in annual profits.

This shift, combined with divestment movements and the potential for stranded assets, reduces the long-term attractiveness of fossil fuel investments.

The Rise and Benefits of Renewable Energy Investments

As the world confronts the challenges of climate change, renewable energy has emerged as a viable and attractive alternative to fossil fuels. Technological advancements and supportive government policies have accelerated the adoption of clean energy sources, making them more affordable and efficient.

Advancements in Solar Technologies

Technological innovations have driven a sharp decline in solar energy costs, largely due to improvements in manufacturing processes and economies of scale. Solar photovoltaic costs have fallen by 90% in the last decade. Costs decrease by around 20% every time global cumulative capacity doubles. Over four decades, solar power has transformed from one of the most expensive electricity sources to the cheapest in many countries.

Market Growth

The clean energy sector is experiencing rapid growth, fueled by environmental concerns and supportive government policies. The U.S. solar industry is expected to install over 250 gigawatts (GW) of new capacity between 2024 and 2029. This surge creates a positive market outlook for solar investments and offers investors opportunities to benefit from incentives and tax credits promoting renewable energy adoption. Starting in 2025, annual growth is projected to average 4%, highlighting the solar industry’s leading role in the transition from fossil fuels to clean renewables.

Why Invest in Utility-Scale Solar Farms?

Investing in utility-grade solar farms offers a strategic opportunity to align financial goals with environmental responsibility.

Scalability

Utility-scale solar farms benefit from economies of scale, which reduce the cost per kilowatt-hour (kWh) of electricity produced. As an example of how economies of scale reduce costs, solar farms cost $1.06 per watt to build while residential installations cost $3.16 per watt.

Large-scale solar farms can purchase materials and equipment in bulk at lower prices. They also streamline operations by consolidating administrative functions and optimizing layout and design to maximize energy production.

Potential Returns

Solar farms generate revenue through the sale of electricity to utilities and consumers. A consistent income stream is often secured by long-term contracts like Power Purchase Agreements (PPAs). PPAs allow power producers to sell electricity at a predetermined price for a specified period, typically ranging from 10 to 25 years. The average internal rate of return on a utility-scale solar farm is 5–8%, depending on project specifics and market conditions. This can equal $5–$8 million in revenue on a $100 million project.

Environmental Impact

Investing in utility-scale solar projects yields more than just monetary gains. These projects offer environmental benefits that traditional investments can’t provide.

Reduces Carbon Footprint

Replacing fossil-fuel energy generation with utility-scale solar installations can save approximately 385,000 to 436,000 pounds of CO₂ per acre per year.

Promotes Sustainable Land Use

Pollinator-friendly solar farms integrate native plants and wildflowers around solar panels, creating habitats for bees and other pollinators.

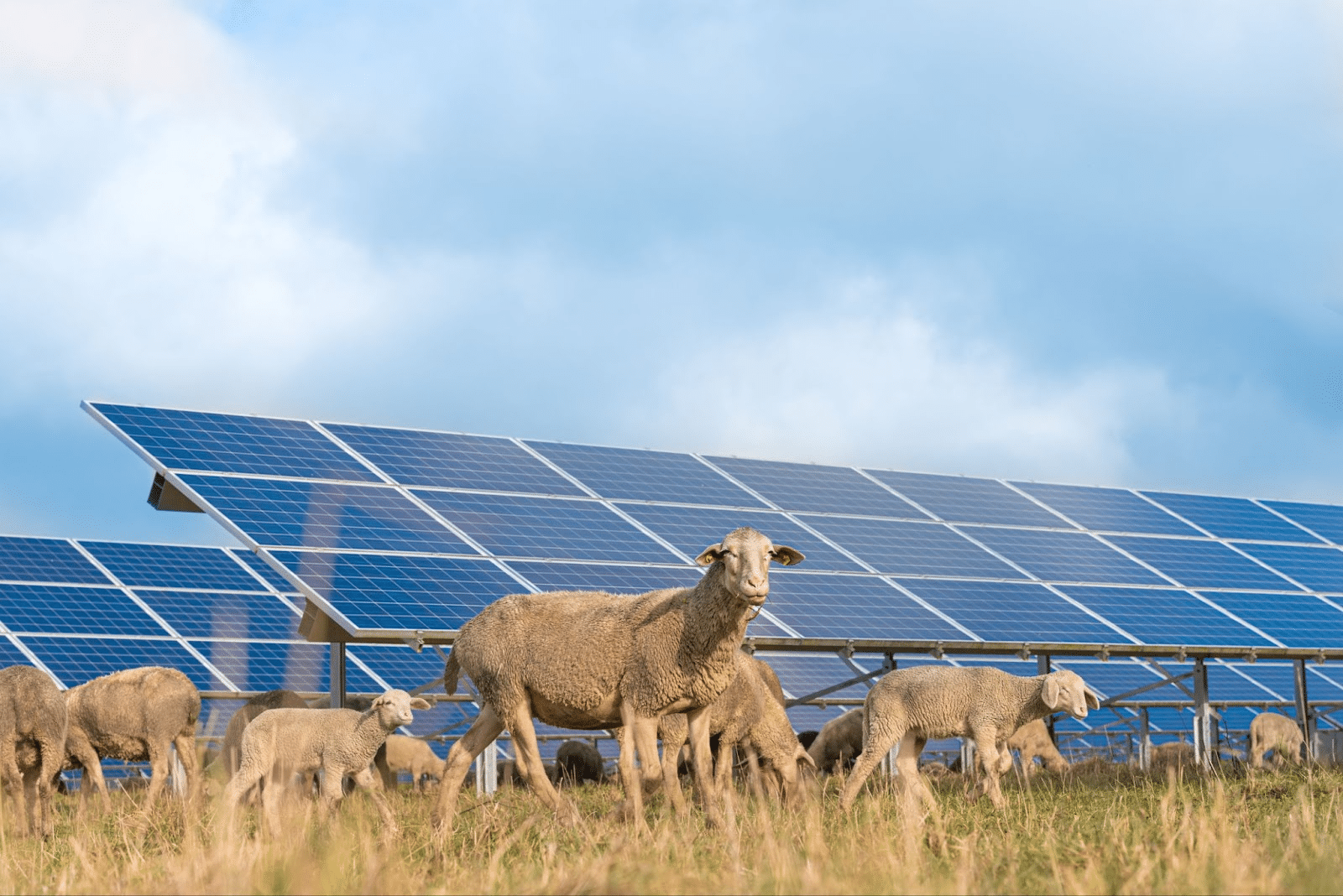

Agrivoltaics

This approach combines solar energy production with agriculture, allowing for the simultaneous use of land for both purposes. Agrivoltaics optimizes land use while maintaining agricultural productivity.

Get Started with Shasta Power

Shasta Power specializes in acquiring and developing utility-grade solar farms, primarily funded through private investments. Our approach begins with identifying suitable land for solar projects. This involves rigorous due diligence to assess site suitability based on factors like solar irradiance, grid connectivity, and environmental impact. We then acquire or lease this land and manage the permitting, engineering, and construction processes.

Shasta Power distinguishes itself through a combination of experience, strategic foresight, and a deep commitment to sustainability. With a track record of successfully executing utility-scale solar projects, we optimize each development for environmental impact and financial return*.

Shasta typically targets a greater than 20% internal rate of return over the life of the fund. We also make it easy for you to invest. Contact us to create an account, verify your eligibility to invest, sign the subscription agreement, and then wire your investment. Our new SPF II fund is expected to open in January 2025.

Non-renewable energy investments carry both environmental and financial drawbacks. They contribute to global emissions, accelerating climate change and its associated costs. Financially, these investments are becoming increasingly risky due to market volatility, regulatory pressures, and declining profitability.

In contrast, renewable energy offers numerous benefits. Advancements in solar technology have made it more affordable and efficient. Investing in renewable energy provides potential financial returns and contributes to environmental sustainability and social responsibility.

Your investment choices have a profound impact. By choosing renewable energy investments, you can be part of a global shift toward sustainability, driving positive change for the planet and future generations.

At Shasta Power, we help investors make a positive environmental and social impact. Visit our solar investment fund information page to learn more about our solar projects and investment opportunities.

*Due to the sensitive nature of our transactions, substantiation of our track record claims is available upon request after executing a non-disclosure agreement.