POSTED

February 9, 2024

How Much Does it Cost to Build a Utility-Grade Solar Farm?

Shasta Power will unravel the cost considerations, benefits, and strategic insights behind integrating utility-grade solar farms into your portfolio, including what they cost to build and maintain and where the most significant opportunities lie.

How Much Does it Cost to Build a Utility-Grade Solar Farm for energy?

Accredited investors today are redefining portfolio diversification and seeking innovative paths beyond traditional investments. Utility-grade solar farms emerge as a strategic and sustainable investment opportunity as you aim to achieve significant financial gains amidst market fluctuations.

We will unravel the cost considerations, benefits, and strategic insights behind integrating utility-grade solar farms into your portfolio, including what they cost to build and maintain and where the most significant opportunities lie.

High-Cost Factors of Utility-Grade Solar Farms

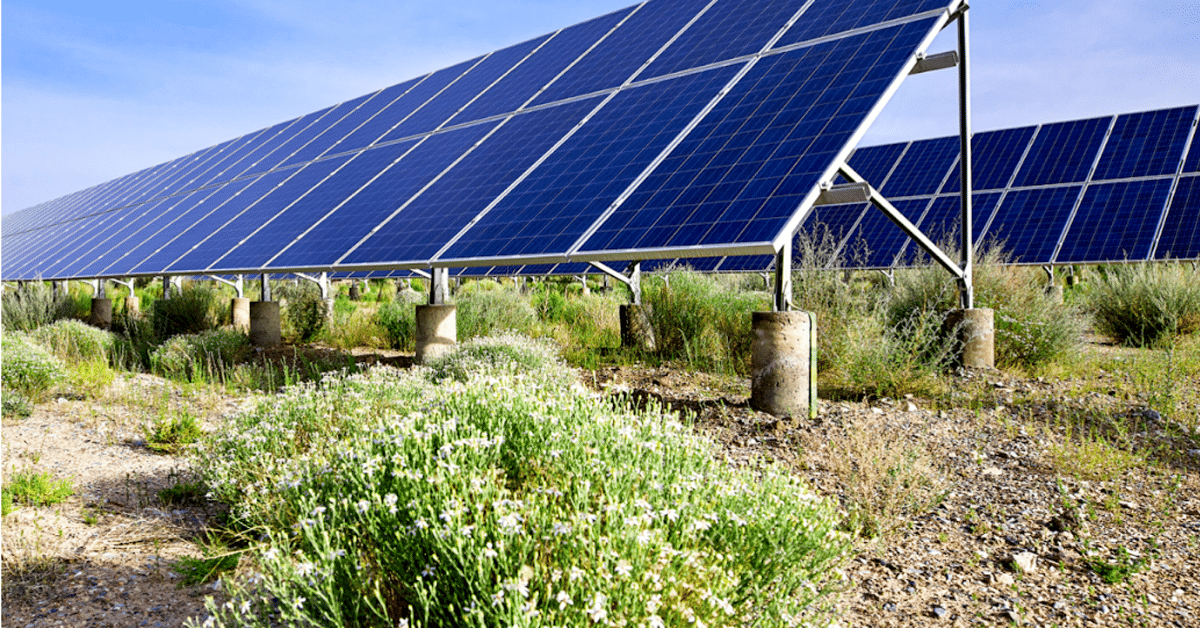

Solar Farm Land Development

Investing in utility-grade solar farms includes acquiring land, installing and maintaining solar panels, and ensuring initial regulatory compliance. These components affect costs and require potential investors to understand the equipment and process comprehensively.

Initial and Ongoing Cost Commitments

Utility-grade solar farm investments demand consideration of initial and ongoing financial and other operational commitments. Beyond land acquisition, mentioned above, developing a solar farm requires substantial investment in engineering, environmental evaluations and surveys, not to mention the costs of installing a project with $10s or $100s of millions in capital expenditures. Once a farm is up an running, the ongoing commitments encompass preventative maintenance, safety compliance, and other operational facets.

Active Administrative Management

Time is a precious commodity whether you’re a busy tech executive or grandparent. Active administrative management refers to the ongoing oversight and decision-making involved in the day-to-day operations of a solar farm. This crucial element comes with associated costs, impacting an investment strategy’s overall returns and success.

How to Balance the Risks & Rewards of Solar Farm Investing

Offload Active Management

As an investor, actively managing investments becomes a challenge. It’s essential to seek hands-on investment results with a hands-off effort for you. These options ensure financial success without the constant need for close monitoring.

Avoid Maintenance Altogether

One critical aspect of balancing the risks and rewards in solar farm investing revolves around initial and ongoing maintenance considerations. While it is impossible to avoid maintenance entirely, proper planning can minimize this cost substantially. The initial phase demands careful investment in high-quality solar panels, reliable infrastructure, and efficient installation processes. Ensuring these elements meet industry standards mitigates immediate risks and sets the stage for long-term success.

Ongoing maintenance is equally pivotal, involving regular inspections, performance monitoring, and proactive repairs. The commitment to sustained efficiency safeguards the investment against potential operational issues and maximizes the solar farm’s overall productivity.

However, with solar development and investing, there are opportunities to minimize initial and ongoing maintenance altogether. We’ll explore that a bit more in the next section.

Land Development

Land development is a crucial aspect of solar farm investing that demands careful consideration. The choice of land significantly influences the success and sustainability of a solar project. Investors must assess the geographic location, topography, and environmental factors to ensure optimal energy production.

Additionally, understanding local zoning regulations and obtaining the necessary permits are pivotal steps in land development. While the right piece of land can enhance energy output and project viability, miscalculations in this phase can lead to increased costs and regulatory hurdles.

Striking the right balance in land development is thus a key factor in managing the risks and maximizing the rewards of solar farm investments. Thorough due diligence and collaboration with experienced professionals can contribute to a strategic approach that mitigates potential challenges and sets the foundation for a successful solar investment venture.

Shasta Power: A Moderate-Risk, High-Reward Opportunity

Exploring the moderate-risk, high-reward category, our Summit Power Fund is an intriguing example. Our investment approach showcases the potential benefits of stepping beyond traditional choices. Investing with us offers a unique perspective on balancing risk and reward.

Seamless Investing with Professional Guidance

Look no further if you’re interested in stress-free solar investment opportunities managed by professionals. Our experienced fund managers at Shasta Power provide the security and knowledge needed for every accredited investor.

Accessible Minimums Starting at $50,000

Dipping into solar investment doesn’t have to be a high-stakes game. With a minimum investment of $50,000, you can join the sustainable energy sector without breaking the bank. It’s a manageable entry point for any accredited investor exploring solar.

Personal and Environmental Impact

Investing in existing solar development goes beyond the numbers. It’s a chance to impact both a personal and environmental level. Your contribution to renewable energy aligns you with environmental values and the positive change needed in the world.

Knowing If Solar Energy Investing Is for You

Your decision should match your dreams. How much risk are you comfortable with? What income are you aiming for? It boils down to your values, what fits your style, and your financial goals.

We explored how you can keep investments steady, lessen risks, and make a difference for yourself and the planet. The Summit Power Fund is a solid choice, mixing personal values, expert management, and a diverse portfolio.

We know that when you make investment decisions, it’s not just about money. Investing is about what matters to you. Learn more about how the Summit Power Fund lets you blend your values with your money plan, offering a well-rounded approach.

If you are interested in investing in solar with Shasta Power, you can watch our free on-demand webinar: 3 Reasons Why You Should Invest Directly In Solar.