POSTED

December 13, 2025

How to Develop a Green Investing Strategy: A Beginner’s Guide

Green investing has evolved from a specialized niche into an accessible strategy for everyday investors. As environmental concerns intensify and clean energy markets mature, investors increasingly seek ways to align their portfolios with sustainability goals without sacrificing financial objectives. Developing a green investing strategy doesn’t require environmental science expertise—it requires understanding key concepts, recognizing available […]

Green investing has evolved from a specialized niche into an accessible strategy for everyday investors. As environmental concerns intensify and clean energy markets mature, investors increasingly seek ways to align their portfolios with sustainability goals without sacrificing financial objectives. Developing a green investing strategy doesn’t require environmental science expertise—it requires understanding key concepts, recognizing available options, and building a portfolio that balances environmental priorities with sound investment principles.

What Is Green Investing?

Green investing involves allocating capital to companies, projects, or funds that contribute to environmental sustainability. According to Investopedia’s definition, green investing focuses specifically on environmental outcomes—renewable energy development, pollution reduction, resource conservation, clean technology innovation, and sustainable agriculture.

While green investing relates to broader concepts like ESG investing and ethical investing, it maintains a narrower environmental focus. Common green investment targets include solar and wind energy developers, electric vehicle manufacturers, water treatment technologies, and energy efficiency solutions.

Green investing pursues dual objectives: generating financial returns while creating measurable environmental benefits. However, green investments carry the same market risks as any other strategy.

Core Concepts Every Green Investor Should Know

Environmental impact versus greenwashing represents a critical distinction. Genuine impact involves measurable, verifiable outcomes—megawatts of clean energy generated, tons of carbon avoided, or gallons of water conserved. Companies delivering real impact provide specific metrics, third-party verification, and transparent reporting. Greenwashing involves vague sustainability claims without substantive environmental benefits. Investors can spot the difference by seeking quantifiable claims, third-party certifications, and examining whether environmental initiatives align with core business operations.

Risk and return in green investing mirror traditional investing. Green investments span from conservative green bonds to aggressive clean technology bets. Some green sectors exhibit higher volatility than broad markets, particularly emerging technologies. Green investing offers no inherent performance advantage—though specific sectors may benefit from long-term structural trends like energy transition. All strategies require careful risk assessment and alignment with financial goals.

Investment vehicles include green mutual funds and ETFs offering diversified exposure, green bonds financing specific environmental projects, public equities in green companies, and private funds providing concentrated exposure to renewable projects, often with higher minimums and longer time horizons.

Key Considerations When Building a Green Portfolio

Define your environmental priorities. The “green” umbrella encompasses climate change, water conservation, biodiversity, pollution reduction, and sustainable land use. Clarifying which issues matter most helps narrow investment choices and maintain focus. A climate-focused investor might emphasize renewable energy and efficiency, while someone concerned with water scarcity might target treatment technologies and infrastructure.

Assess your risk tolerance and time horizon. Green investments span from stable renewable projects with long-term contracts to speculative clean technology ventures. Your risk tolerance and timeline should guide selections. Green sectors benefiting from structural trends may experience near-term volatility but potentially strong long-term performance. Environmental goals shouldn’t override fundamental financial needs—green investing should enhance rather than jeopardize overall financial security.

Understand what you’re investing in. Research business models and revenue sources. What percentage of revenue comes from genuinely green activities versus conventional operations? Verify environmental claims through third-party sources like sustainability ratings agencies rather than company marketing. Look for transparency in environmental reporting and understand regulatory dependencies, as some business models rely heavily on subsidies or policies that could change.

Consider costs and fees. Some actively managed green funds carry significantly higher expense ratios than broad market index funds. According to SmartAsset’s analysis, evaluate whether fees are justified by performance. Index-based green ETFs increasingly offer cost-effective access with expense ratios comparable to conventional index funds.

Diversification still matters. Environmental focus doesn’t eliminate the need for diversification across sectors, geographies, and company sizes. A portfolio concentrated entirely in solar faces significant risk if solar-specific challenges emerge. Green allocations should complement rather than dominate overall portfolio construction. Balance environmental objectives with prudent portfolio management.

Common Green Investing Strategies

Thematic focus concentrates portfolios on specific environmental themes like renewable energy or clean water. Benefits include clear impact alignment and exposure to potentially high-growth sectors. However, thematic concentration creates sector-specific risks and higher volatility. This strategy may suit a portfolio portion rather than complete holdings, particularly for investors with strong convictions, longer time horizons, and capacity to absorb volatility. This is repeated. Perhaps take one out?

Green fund and ETF strategies involve professionally managed vehicles focused on environmental themes. These provide instant diversification, professional selection, and accessibility. GreenFi’s guide notes that green funds vary widely—some focus narrowly on pure-play environmental companies while others take broader approaches. Understand each fund’s methodology, holdings concentration, and fees. This approach may work as a core green allocation, particularly for beginners seeking simplicity.

Best-in-class selection chooses companies with superior environmental performance within each sector rather than excluding industries. This maintains diversification while directing capital toward environmental leaders. Benefits include avoiding tracking error from sector exclusions and rewarding environmental excellence. However, it requires substantial research and may feel uncomfortable for investors who prefer avoiding high-impact sectors entirely. This approach suits investors wanting environmental emphasis without dramatic concentration.

Exclusionary strategies systematically avoid environmentally harmful industries like fossil fuels or heavy polluters. Benefits include clear values alignment and avoiding regulatory risks in excluded sectors. However, exclusions reduce diversification and create tracking error versus benchmarks. This strategy suits investors with strong environmental convictions who accept potential performance differences in exchange for values alignment.

Blended strategies combine multiple approaches—perhaps a green ETF core plus thematic renewable allocation plus fossil fuel exclusions. This offers flexibility and customization but requires more active management and monitoring. This approach may suit most investors seeking tailored portfolios rather than one-size-fits-all solutions.

Always remember that all investing carries risk and that past performance doesn’t guarantee future returns. Each strategy involves trade-offs between impact, risk, and diversification.

Practical Steps to Get Started

Educate yourself about environmental issues and investment fundamentals. Understanding challenges that green investments address helps evaluate which solutions are promising. Research available options by reviewing fund prospectuses, examining holdings, and comparing expense ratios. Resources like Investopedia provide accessible explanations.

Assess your current portfolio to understand existing environmental exposure and identify opportunities. Review holdings to determine if you already own companies with environmental operations. Identify any holdings conflicting with environmental goals. Consider where you could add green allocations without creating excessive concentration.

Start small and build gradually. Beginning with a modest allocation—perhaps 5-10% in a diversified green fund—allows gaining experience before larger commitments. This reduces risk of poorly timed investments while providing meaningful exposure. As knowledge grows, increase allocations or add thematic investments.

Monitor and adjust periodically. Review green investments annually or semi-annually, verifying companies maintain environmental commitments. Stay informed about trends and policy changes affecting holdings. Rebalance to maintain desired allocations, but avoid excessive trading based on short-term performance.

Consider professional guidance if portfolio construction feels overwhelming. Financial advisors increasingly offer sustainable portfolio services, helping align environmental values with comprehensive financial plans. Verify advisors have genuine sustainable investing expertise and ensure recommendations align with your priorities.

The Role of Utility-Scale Solar in Green Portfolios

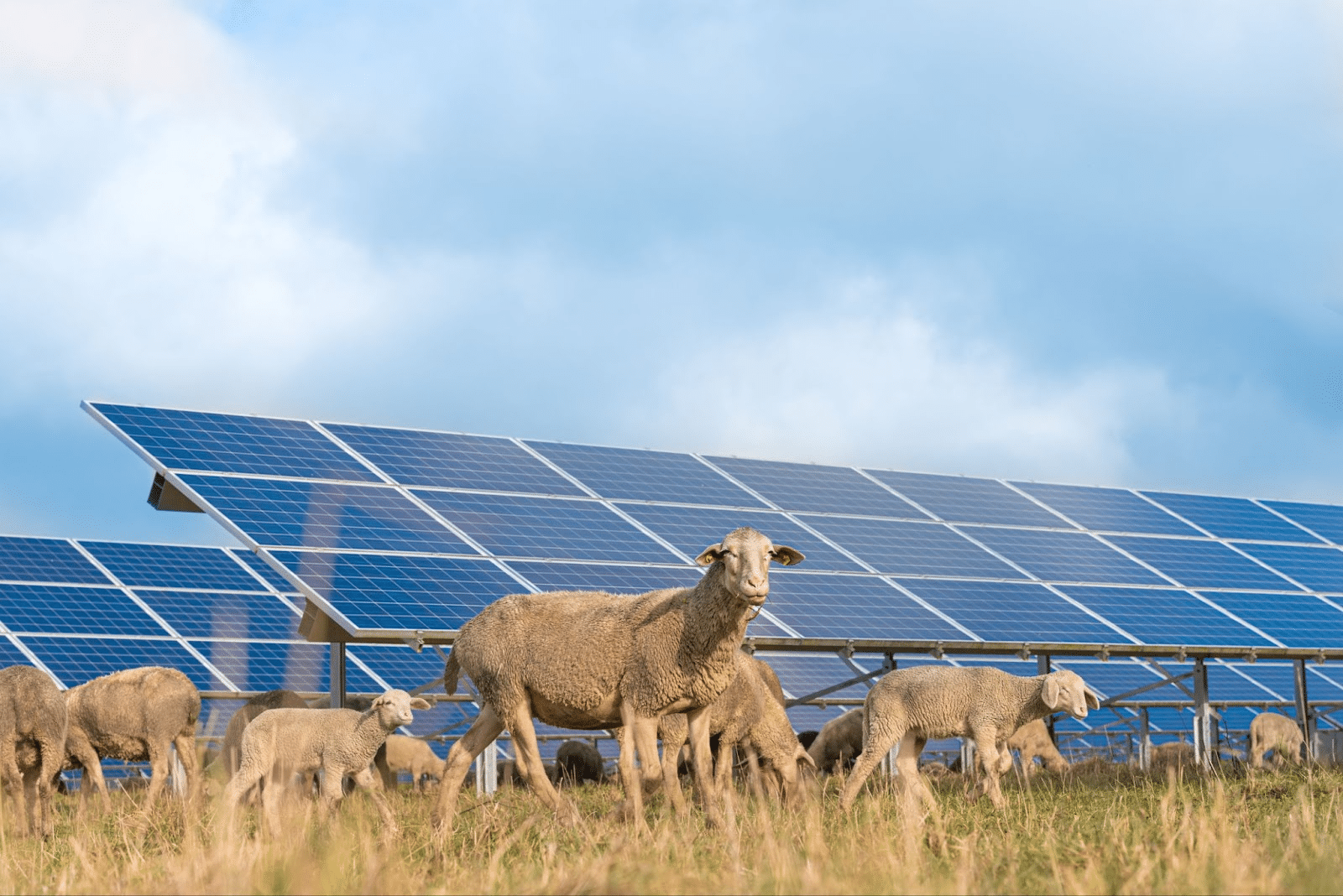

Utility-scale solar energy occupies a distinctive position as both proven technology and a cornerstone of the energy transition. According to the U.S. Energy Information Administration, over 30 GW of utility-scale solar came online in 2024. Solar offers mature technology with decades of operational history, strong economic fundamentals with competitive costs, measurable environmental impact through fossil fuel displacement, and long-term contracted revenues providing income stability.

Solar investments fit multiple strategies. For thematic investors, utility-scale solar delivers concentrated climate solution exposure. For green funds, solar developers commonly appear given clear green credentials. For best-in-class approaches, leading solar companies demonstrate environmental excellence. Solar naturally passes exclusionary screens by avoiding fossil fuels.

At Shasta Power, we focus on early-stage solar project development—securing land rights, advancing permitting, and preparing projects for construction. This approach creates value during development while managing execution risk, offering concentrated renewable energy exposure with measurable impact metrics. For green investors prioritizing climate action, utility-scale solar provides tangible environmental benefits alongside financial returns.

Conclusion

Developing a green investing strategy requires understanding available options, honestly assessing priorities and risk tolerance, and building portfolios that balance environmental goals with sound investment principles. Whether you choose thematic concentration, diversified funds, best-in-class selection, exclusionary approaches, or blended strategies, alignment between your values, financial circumstances, and timeline is key.

Start with education and modest allocations, building gradually as knowledge and confidence grow. Remember that all investing involves risk—green investments face the same market uncertainties as conventional portfolios. However, even modest green allocations contribute to environmental transition while potentially positioning portfolios to benefit from long-term structural shifts toward sustainability.

If you’re ready to explore how utility-scale solar can strengthen your green investment strategy, connect with Shasta Power to learn about opportunities in solar project development.