POSTED

November 15, 2024

Why Utility-Scale Solar Investment Funds Outperform Real Estate

Real estate has been a cornerstone of wealth-building strategies for generations. However, in today's world, a new contender is emerging: utility-scale solar investments. As the global focus shifts toward sustainability and combating climate change, solar farms are not just a green alternative but a potentially profitable one as well.

Investors are increasingly seeking opportunities that grow their financial portfolios while making a lasting environmental impact. This is where solar energy shines, offering stable, long-term returns and the chance to be part of the solution to one of the most pressing global challenges. In this article, we’ll explore the financial advantages of utility-scale solar investments and the ethical benefits of investing in a cleaner, greener future.

Real Estate Volatility

Investing in real estate can be unpredictable due to several factors. Property values often vary greatly by geographic region. A house in a high-demand city may appreciate, while one in a less desirable area could stagnate or depreciate. In booming markets, an oversupply of properties can drive down prices. Conversely, limited inventory can lead to price hikes. Interest rates, inflation, and economic cycles influence real estate. During recessions, property values tend to decline, and market corrections can cause sharp fluctuations in asset value, making real estate less predictable.

Financial Benefits of Utility-Scale Solar Investment Funds

The renewable energy sector, particularly solar energy, is experiencing rapid and sustained growth and utility-scale solar farms are the main driver of this growth. Global installations of utility-scale solar farms grew to 400 GW in 2023 and are projected to increase to 670 GW by 2028. Over the next five years, the International Energy Agency (IEA) expects that renewable power capacity additions will continue to increase, with solar and wind power accounting for 96% of new capacity.

Resilience During Economic Downturns

Investments in solar farms have demonstrated resilience during economic downturns. This resilience stems from the essential nature of electricity as a commodity. Demand for electricity grows and remains relatively stable even during economic recessions. For example, during the COVID-19 pandemic, many sectors experienced sharp declines. The renewable energy sector, however, showed strong resilience.

Counterbalance to Volatile Assets

Solar farm investments can serve as a counterbalance to more volatile assets in an investment portfolio. They do not correlate closely with the stock market or other traditional asset classes, meaning they can reduce overall portfolio risk. This non-correlation makes solar farms an effective tool for investors seeking to reduce exposure to economic cycles or mitigate the risk of market downturns. The average internal rate of return (IRR) on a utility-scale solar farm is 5-8% depending on project-specific and market conditions. This can equal $5-$8 million in revenue on a $100 million project.

As an example, Shasta’s Summit Power Fund typically targets an IRR greater than 20%. We achieve this high IRR by maximizing development stage value, through partnerships with Independent Power Producers (IPP) for construction and operation. These IPPs seek shovel ready projects, and benefit from fully acquiring the assets once they are built. In the partnership process, they pay a premium for us developing and de-risking the project. We also make it easy for you to invest. Contact us to create an account, verify your eligibility to invest, sign the subscription agreement, and then wire your investment.

The Environmental Benefits of Utility-Scale Solar Investment Funds

Utility-scale solar projects offer environmental benefits that real estate investments typically can’t.

Reduce Carbon Footprint

Replacing fossil-fuel energy generation with utility-scale solar installations can save approximately 385,000 to 436,000 pounds of CO₂ per acre per year. This substantial reduction in carbon emissions helps in the fight against climate change.

Promote Sustainable Land Use

Pollinator-friendly solar farms integrate native plants and wildflowers around solar panels, creating habitats for bees and other pollinators. This practice enhances biodiversity and supports agricultural productivity in surrounding areas.

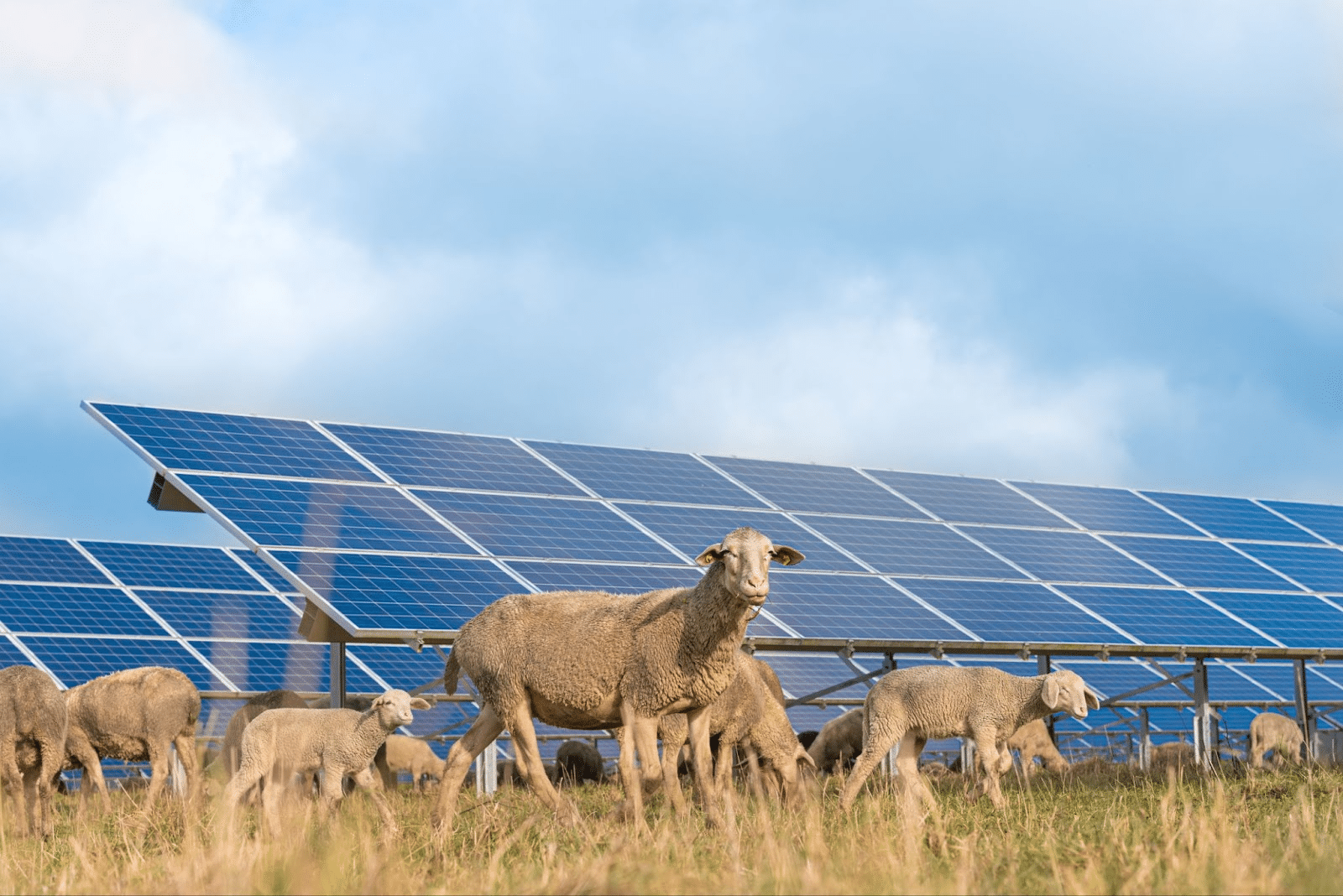

Agrivoltaics

Agrivoltaics combines solar energy production with agriculture, allowing for the simultaneous use of land for both purposes. This approach optimizes land use and maintains agricultural productivity, offering a balance between energy generation and farming.

The Social Benefits of Utility-Scale Solar Investment Funds

Utility-Scale solar projects also have a wide range of positive impacts on communities.

Create Green Jobs

During the building phase alone, a single large solar farm can create hundreds of jobs over several months or even years. These jobs contribute to local economies and support the transition to a green workforce.

Develop Infrastructure

Utility-scale solar farms often lead to upgrades in local infrastructure, like roads and electrical grids, to support the new installations. These upgrades result in a more resilient grid for the host communities.

Boost Local Economies

Local communities can see increased spending by workers involved in the construction and maintenance of utility-scale solar farms. Solar farms can also provide local governments with increased tax revenue from higher property taxes, sales tax, and income taxes.

Utility-scale solar farms can offer predictable, long-term returns supported by growing market demand. They also allow investors to play an active role in the fight against climate change. Solar investment funds provide a more stable and low-risk alternative to real estate, offering impact-driven opportunities that make them a better choice for environmentally conscious investors. By investing in solar energy, you’re not only securing your financial future but also contributing to a sustainable planet.

At Shasta Power, we help investors make a positive environmental and social impact. Visit our investment information page to learn more about our solar projects and investment opportunities.