POSTED

October 4, 2024

Green Growth: Integrating Solar Farms for Diversified Investment Returns

Sustainability is top of mind for investors. Sustainable investments accounted for more than a third of all global assets under management, totaling $35.3 trillion. The growth in sustainable investments reflects a growing commitment to support initiatives that prioritize profit and purpose.

Renewable energy investments are more crucial than ever before. Left unchecked, global warming will increase the risks of extreme weather events, accelerate the collapse of biodiversity, and do unrecoverable damage to Earth’s systems. Overall, climate change is projected to cause around 250,000 additional deaths per year. Clearly, something needs to be done.

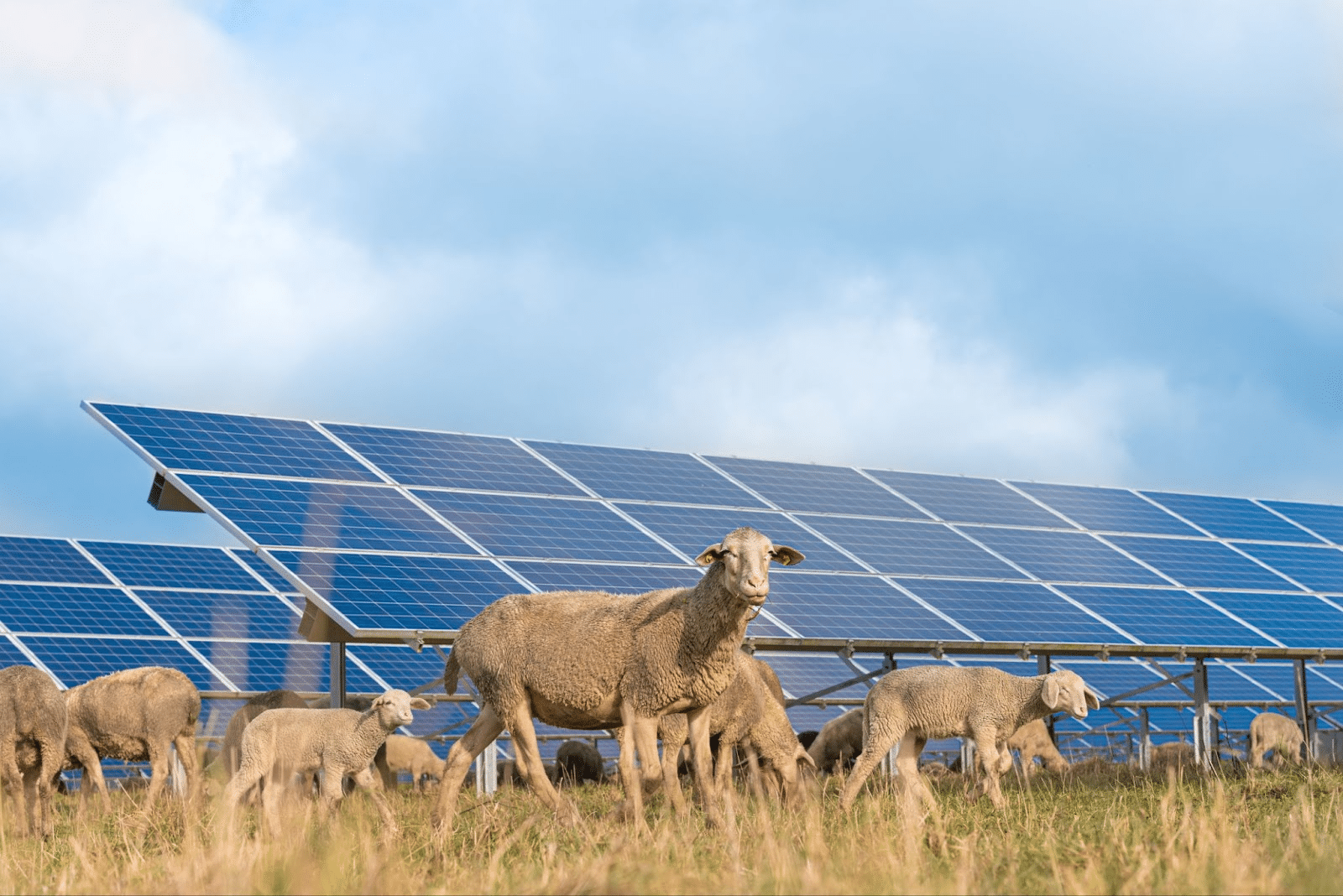

Responsible investment plays a key role in creating a greener future. By investing in utility-scale solar farms, you can align your financial goals with your values, helping to advance sustainable power projects while still seeking competitive returns. Here’s a look at how investing in utility-scale solar farms can offer diversified returns that can outperform traditional investments.

What is Impact Investing?

Simply put, impact investing is a strategy that seeks to generate measurable social or environmental impact alongside financial returns. Impact investing starts with defining the environmental outcomes you hope to influence. You then need to determine what kind of financial return you want from your investment. The range of expected returns can vary from below market to market rate and is entirely dependent on your individual goals. As an impact investor, you also commit to measuring and reporting on the environmental performance of your investments.

This type of investing is becoming increasingly popular. Rising awareness and demand for sustainability, particularly with millennial and GenZ investors, is pushing financial institutions to offer more sustainable investment options. The financial returns also attract new investors. In fact, sustainable funds outperformed traditional funds with a median return of 12.6% and 8.6%, respectively.

Impact investing is also seeing a shift toward investments that address climate change, with more than 50% of individual investors saying they anticipate increasing allocations to sustainable energy investments.

Unique Benefits of Investing in Solar Farms

Utility-scale solar is one of the most effective ways to reduce carbon emissions. Energy from fossil fuels can emit up to 2,315 pounds of CO2 equivalent per megawatt hour (MWh). Replacing fossil-fuel energy generation with utility-scale solar installations can save approximately 385,000 to 436,000 pounds of CO2 per acre per year.

Solar farm projects also help local and state economies. During the building phase alone, a single utility-scale solar project can create hundreds of jobs over several months or even years. These projects can also lead to upgrades in local infrastructure. During a project, roads and electrical grids often need to be updated to accommodate the project. This can be a huge win for small communities, improving local utilities and attracting additional investments in the community.

Beyond the environment and social benefits, the demand for solar energy is growing. Global installations of utility-scale solar farms grew to 440 gigawatts (GW) in 2023. This growth isn’t slowing down either. By 2027, that number is expected to increase to 590 GW. The growing demand coupled with positive social and environmental impacts makes utility-scale solar an attractive option for investors.

Even better, the average internal rate of return on a solar farm project is 5-8%, depending on the project specifics and market conditions. This can equal $5-$8 million in revenue on a $100 million project.

The Role of Solar Farms in Diversifying an Investment Portfolio

Utility-scale solar projects can be a compelling way to diversify your investment portfolio. For example, investments in solar farms have been shown to be resilient during economic downturns. Solar farm investments can also serve as a counterbalance to more volatile assets in your portfolio.

Since solar investments do not correlate closely with the stock market or other traditional asset classes, they can reduce overall risk in your portfolio, making them an effective tool for diversification. This is particularly true for investors looking to reduce exposure to economic cycles or mitigate the risk of a market downturn.

By incorporating solar farm investments into your portfolio, you can achieve a more balanced and diversified portfolio while contributing to the global transition to clean energy.

Why Choose Shasta Power?

Shasta Power specializes in acquiring and developing utility-grade solar farms. We leverage private investment to fund these projects, creating opportunities for investors to participate in the clean energy transition while achieving competitive returns. Shasta distinguishes itself through a combination of experience, strategic foresight, and a deep commitment to sustainability. With a track record of successfully executing utility-grade solar projects*. Shasta Power ensures each development is optimized for both environmental impact and financial return. Our Summit Power Fund typically targets a greater than 20% internal rate of return (IRR) over the life of the fund.

The world needs responsible investors. Impact investing can be a powerful way to support environmental change and achieve financial returns. Utility-scale solar farms are one of the best ways to do this. Not only can they help diversify your portfolio, but they can also be a significant driver of social and environmental change.

At Shasta Power, we help investors make a positive environmental and social impact. Visit our investment information page to learn more about our solar projects and investment opportunities.

*Due to the sensitive nature of the transitions, substantiation of our track record claims are available upon request after executing a non-disclosure agreement.