POSTED

February 24, 2023

How To Protect Your Real Estate Investments During a Recession

A recession is a period of economic contraction, typically lasting several months to many years. Therefore, it can naturally have a major impact on real estate investments. With a fair share of potential risks associated with investing in real estate during a recession, there are also some excellent opportunities to consider before deciding to wait […]

A recession is a period of economic contraction, typically lasting several months to many years. Therefore, it can naturally have a major impact on real estate investments. With a fair share of potential risks associated with investing in real estate during a recession, there are also some excellent opportunities to consider before deciding to wait for better economic times. Shasta Power takes a look at how you can protect your real estate investments in the midst of an economic downturn:

Look for Long-Term Investment Opportunities

During a recession, it’s essential to focus on long-term investments instead of quick flips or short-term rentals. Look for properties with the potential for appreciation or income generation through steady rent payments over time. Such investments are often more stable and less vulnerable to market changes than short-term investments are, making them ideal for protecting your investments during economic storms.

Anytime you invest in real estate, you’ll want to thoroughly research the current rental prices. This helps ensure that any property you’re considering can generate enough income to cover the associated taxes and other expenses. Knowing the average rental prices for a specific area will give you an idea of how much you can make from your investment. Plus, rental rates tend to fluctuate over time, so staying up to date on prices is crucial to your long-term success.

Understand the Risks and Opportunities

It’s also important to fully grasp the risks and opportunities associated with investing in this kind of market. A recession can cause property values to drop, making it harder for investors to sell their properties at a profit. Then again, recessions present investors with opportunities to buy properties at significantly lower prices that they can then hold on to for appreciation when the economy recovers.

Regularly dedicate time to learning more about balancing your risks and opportunities. And don’t underestimate the value of an experienced real estate agent or other experts who can help you make intelligent decisions.

Be Prepared for Changes in the Market

Another way to protect your investments during a recession is to prepare for any changes that could occur in the market. This means staying current on any news related to the economy and real estate market so that you can make informed decisions about your investments.

You’ll also want to keep an emergency fund available to cover any unexpected expenses that might arise from market changes. And you need to have an exit strategy for each investment so that you know precisely what you will do if things don’t pan out as expected.

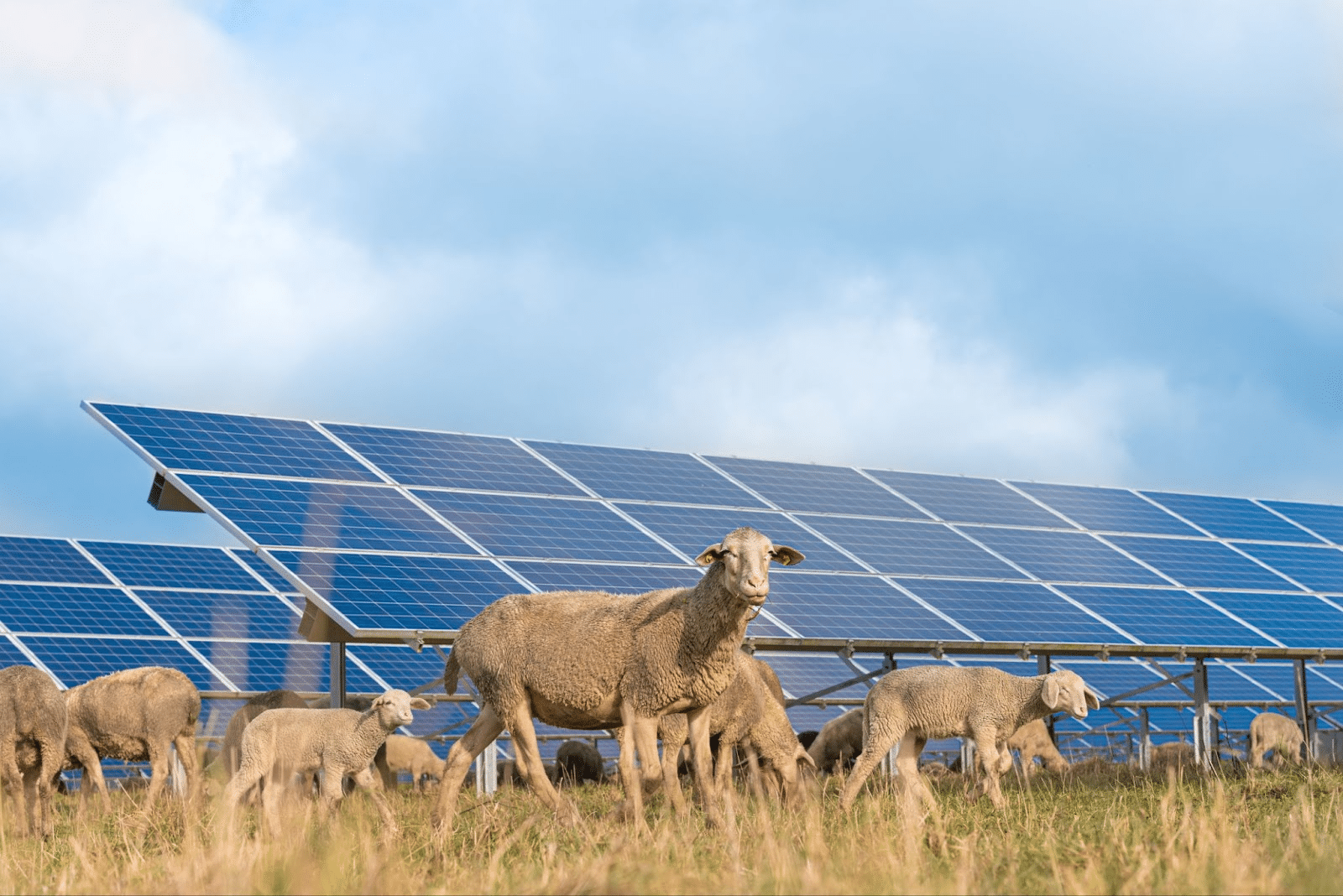

Consider Going Solar

Investing in renewable energy sources like solar power can be wise when you own rental properties. Solar energy systems provide free and clean electricity to tenants, reducing their (and your) overall energy costs, making the property more attractive to potential tenants, and increasing its value.

As a bonus, many jurisdictions offer lucrative tax rebates and incentives for using solar energy on rental properties. In other words, taking advantage of solar energy is an investment that can pay dividends now and in the future. Connect with Shasta Power to learn about how we can help you get started!

Wrapping Up

Recessions come with risks and opportunities for real estate investing, but they don’t have to be scary or overwhelming if you know how to protect yourself and your investments. By focusing on long-term opportunities, regularly engaging the risks and opportunities, and being prepared for potential market changes, you can ensure that your real estate investments remain safe even in the toughest of economic times. Keep the information and advice above in mind as you seek to bolster your financial future, and remember to stay positive as you navigate the challenges ahead!

Would you like to read more helpful content or learn about investing in solar energy? Visit ShastaPower.com today!