POSTED

December 27, 2024

Resilient Investing: How Utility-Scale Solar Funds Brave Economic Storms

Investors today want their money to grow and make a positive difference in the world. With climate change at the forefront of global concerns, more people are seeking ways to align their portfolios with their environmental values. Over 3,907 organizations now manage $1.571 trillion in impact investing assets worldwide, reflecting a 21% compound annual growth rate since 2019. Utility-scale solar funds offer a unique opportunity to achieve financial returns while contributing to a sustainable future.

Traditional investments often suffer during economic downturns. In contrast, renewable energy projects like utility-scale solar farms have shown remarkable resilience. In this article, we’ll explore how investing in utility-scale solar funds can provide financial stability and make a meaningful environmental impact.

The Resilience of Utility-Scale Solar Investments

Solar farm investments have proven durable during economic downturns, serving as a stable counterbalance to more volatile assets. Since electricity is an essential commodity, demand remains relatively steady even during recessions. For instance, during the COVID-19 pandemic, many sectors faced sharp declines while the renewable energy sector maintained a strong performance.

Economic Stability

Long-term contracts like Power Purchase Agreements (PPAs) often secure a consistent income stream. PPAs enable power producers to sell electricity at a predetermined price for a set period, usually between 10 and 25 years. By locking in rates for both buyers and developers, PPAs reduce exposure to fluctuating energy prices. These agreements shield both parties from volatility in traditional energy markets, offering financial predictability even during tough economic times.

Consistent Growth

The demand for clean energy is rapidly increasing, driven by environmental concerns and supportive government policies. From 2024 through 2029, the U.S. solar industry is on track to install over 250 GW of capacity. This trend enhances the market outlook for solar investments, with opportunities to further benefit from incentives and tax credits promoting renewable energy adoption. Annual growth is expected to average 4% from 2025 onward. The solar industry continues to be the leading technology in the energy transition from fossil fuels to clean renewables.

Energy Demand

Energy consumption remains relatively steady regardless of economic conditions, as electricity is essential for businesses and households. In 2023, global energy consumption grew by 2.2%, faster than the average growth rate from 2010–2019. Global electricity demand is expected to increase by an average of 3.4% annually through 2026. This growth is driven by economic expansion, electrification of the residential and transportation sectors, and the expansion of the data center sector. This consistent demand keeps solar farms active, so their output continues to be utilized under long-term agreements.

Decreasing Costs

The levelized cost of energy (LCOE) has decreased, falling to $39/MWh in 2022. The LCOE was as low as $29/MWh when factoring in federal investment tax credits. This reduction in costs has helped improve the profitability and attractiveness of solar investments. The average market value of solar increased by 40% to $71/MWh in the same year. This indicates a growing economic attractiveness for solar investments.

Financial Benefits of Investing in Utility-Scale Solar

As costs continue to decline and demand surges, utility-scale solar farms have reached unprecedented levels of profitability. Typically, these projects offer an average internal rate of return (IRR) between 5% and 8%, depending on specific project details and market conditions. An investment of $100 million could result in revenues ranging from $5 million to $8 million.

At Shasta Power, we aim higher—targeting an IRR exceeding 20% over the fund’s lifespan. We’ve streamlined the investment process for your convenience. Simply reach out to open an account, verify your investment eligibility, sign the subscription agreement, and then wire your funds. Our upcoming SPF II fund is anticipated to launch in January 2025.

Environmental Impact of Solar Investments

Investing in large-scale solar projects offers environmental advantages that traditional investments simply cannot match. By transitioning from fossil-fuel energy generation to utility-scale solar installations, we can prevent the emission of approximately 385,000 to 436,000 pounds of CO₂ per acre each year. This significant decrease in carbon output directly contributes to the fight against climate change.

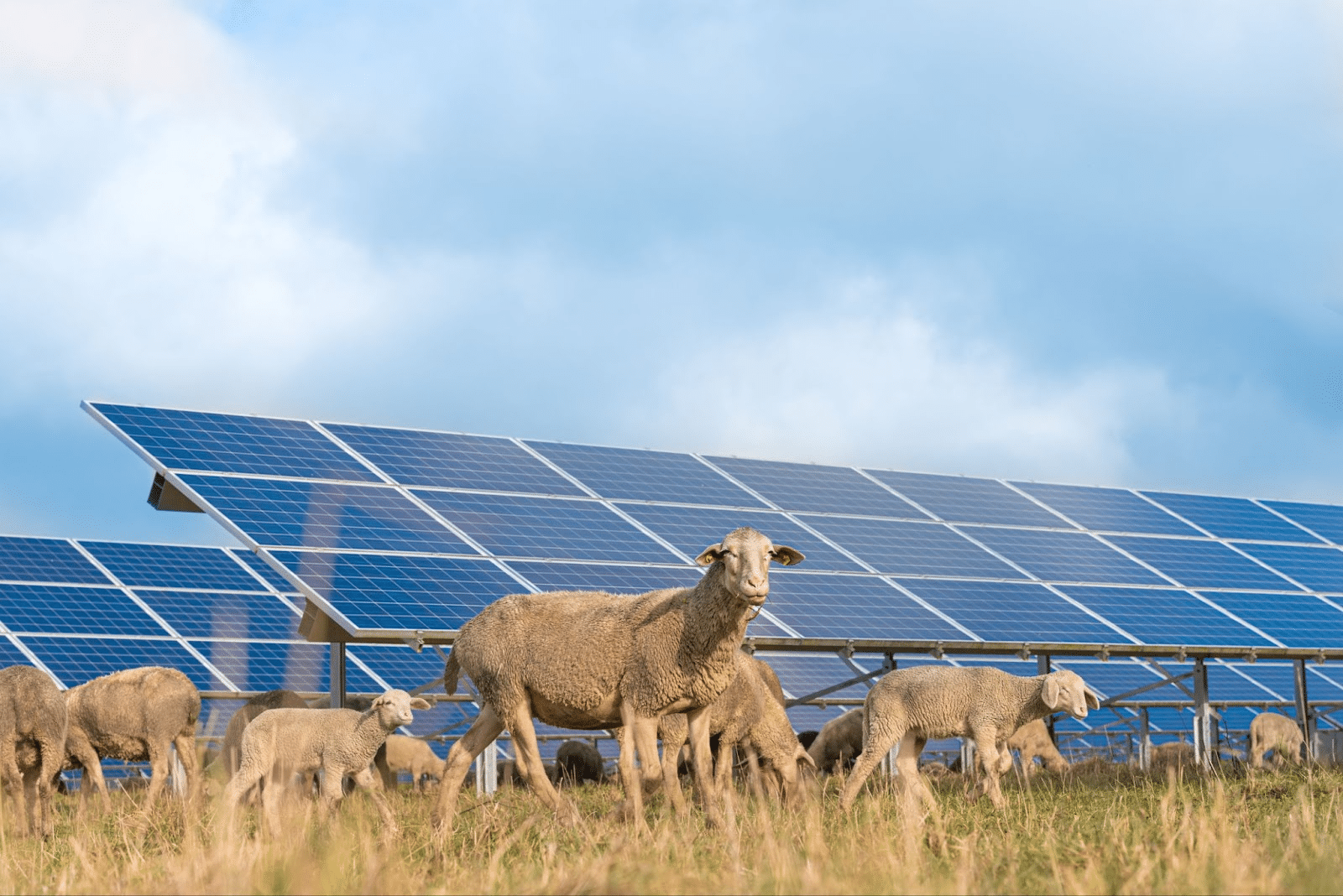

Additionally, these projects promote sustainable practices in land use. Pollinator-friendly solar farms incorporate native plants and wildflowers around their panels, creating habitats for bees and other pollinators. This initiative not only enhances biodiversity but also improves the health of local ecosystems. Furthermore, agrivoltaics—a practice that combines solar energy production with agriculture—enables the land to serve dual purposes simultaneously. This innovative approach maximizes land efficiency and sustains agricultural productivity, allowing for the production of food and energy on the same plot of land.

Get Started with Shasta Power

Shasta Power specializes in the acquisition and development of large-scale solar farms, primarily financed through private investments. Our process begins with meticulous land selection, ensuring it is ideal for solar energy projects. This involves thorough due diligence to evaluate site potential based on factors like solar irradiance, grid accessibility, and environmental considerations. Once we identify suitable land, we secure it through purchase or lease agreements with options. We then oversee the entire development lifecycle, including permitting, engineering design, and construction. This ensures our solar farms meet the highest industry standards.

What sets Shasta Power apart is our unique combination of experience, strategic foresight, and an unwavering commitment to sustainability. With a proven track record of successfully executing utility-scale solar projects, we optimize each development for both environmental stewardship and financial performance*. By leveraging private investment, we offer investors the opportunity to participate in the clean energy transition while achieving competitive returns.

Investing in utility-scale solar funds offers financial stability while supporting environmental sustainability. These investments remain resilient during economic downturns, providing consistent returns and benefiting from government incentives. By aligning your financial choices with environmental values, you contribute to combating climate change and promoting a sustainable future. Utility-scale solar investments help create a cleaner world, enduring economic challenges and delivering tangible positive impacts.

At Shasta Power, we help investors make a positive environmental and social impact.

*Due to the sensitive nature of our transactions, substantiation of our track record claims is available upon request after executing a non-disclosure agreement.