POSTED

September 1, 2023

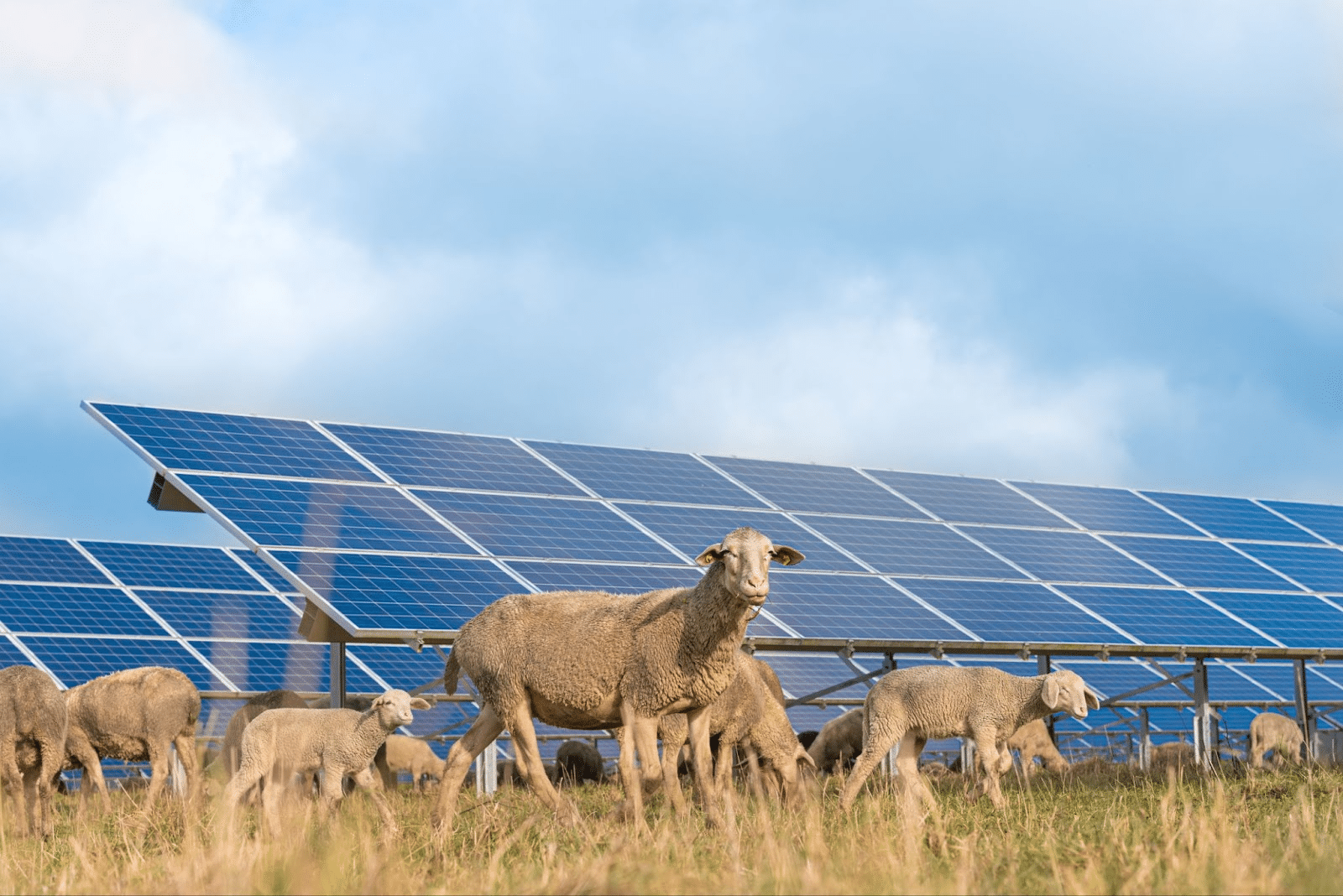

Why Accredited Investors Should Privately Fund Utility-Grade Solar Projects

If you are an accredited investor interested in investing in solar, you should invest at scale, privately. Privately funded solar projects offer a unique balance of return on investment and direct impact, making hundreds of millions of dollars possible and improving tens of millions of lives. Let’s look at the reasons you should invest in […]

If you are an accredited investor interested in investing in solar, you should invest at scale, privately. Privately funded solar projects offer a unique balance of return on investment and direct impact, making hundreds of millions of dollars possible and improving tens of millions of lives. Let’s look at the reasons you should invest in a private solar fund.

1. Privately funded solar projects Generate a significantly high return on investment

If your primary goal with solar investing is to simply earn some kind of return, opting to invest in solar stocks or public mutual funds is not a bad option. Your solar stocks or public mutual funds will undoubtedly be diversified and come with relatively low risk.

However, if you choose to invest in low-risk solar stocks or public mutual funds, you are limiting the “risk” of a high return. You will receive less direct insight into where your funds are going, knowing they may be going to any part of the solar process, including manufacturing.

It is true that investing in private solar funds is more risky! It also gives back higher returns, more flexibility, and personal insight.

Through Shasta Power’s Summit Power Fund, investors diversify the risk of investing in utility-grade solar through multiple projects, and can earn an anticipated annualized return of 30%. The Summit Power Fund provides investors access to the best possible fundamentals including refundable utility deposits, zero debt, diversified funds, projects sold before construction, and a team of accredited investors.

2. Diversify your portfolio with a leading power sector investment vehicle

Worldwide, investments in clean energy have grown exponentially, at an average rate of 12% every year since 2020. This year alone, we expect global energy investment to surge by more than 8%, reaching $2.4 trillion. Solar with battery storage is increasingly in demand, with Solar Photovoltaics as the leading power sector investment.

Other types of investments like ESG, SRI, Impact Investing, EFTs, and Stocks allow you to invest in what is generically called “alternative energy” or “renewable energy.” There is no better time than now to invest directly in solar. With a private utility-grade solar fund, you are specifically investing in solar and not other things generally associated with clean energy.

3. Privately funded solar projects Make a life-changing impact on the environment

The product that has been the world’s leading energy source for over a century is retiring. We’re talking about coal, of course.

Coal has created a devastating legacy of damage to the health of both people and the planet, and economic factors are pushing it toward extinction. As people become more aware, they are putting their political will behind replacing coal with renewable energy.

Investing in utility-grade solar can be instrumental if you are looking for a way to help replace coal. You could help the world convert to renewable energy, displace carbon emissions, move the United States away from relying on foreign energy sources, and create jobs in communities that desperately need them.

Consider investing in the Summit Power Fund

If you want a generic way to invest in utility-grade solar, you can opt for mutual funds, stocks, and EFTs. If you seek an investment that guarantees your connection to the change you are assisting in implementing, Shasta Power’s Summit Power Fund is the right choice for you.

The Summit Power Fund is leading the transformation from dirty energy to a sustainable future. It is truly unique in its strong execution and track record while still maintaining a lean operation. The Summit Power Fund had an early entrance into an underdeveloped market, putting us at the forefront. We dedicate ourselves to making insightful decisions in a timely manner and continually tracking analytics to optimize siting and performance.

Are you ready to take advantage of this opportunity to invest in a unique private investment fund? Watch our webinar to find out if it’s the right fit for you.

My company Solar Nation Inc would like to be funded by solar energy private investors. I have many renewable energy projects, therefore, my company would ask private investors for startup funding

Thank you so much

Good luck with your fundraising efforts!