POSTED

May 6, 2022

4 Reasons You Need To Invest In A Private Solar Fund

Solar funds like our Summit Power Fund have several performance advantages over their publicly traded counterparts, particularly for accredited investors.

Investment performance is the difference between parabolic growth in your portfolio and stagnation. Private solar funds like our Summit Power Fund have several performance advantages over their publicly traded counterparts, particularly for accredited investors.

Investment performance is the difference between parabolic growth in your portfolio and stagnation.

– Shasta Power

The wealthiest person in the world, Elon Musk knows this and has tried to take several of his companies private to capitalize on these advantages; reportedly, taking Twitter private is the most recent example.

But how do private solar funds outperform public solar stocks for investors?

1. Private solar fund Investors earn significant returns

This happens, because they are invested straight into the solar development, not into a labyrinthine corporate structure. As a result, there is a minimal dilution of profits for investors in private funds under the vastly simpler architecture of private firms, in most cases than in publicly traded companies.

Public companies often spend millions of dollars sustaining their bloat and, due to overconfidence, frequently fall victim to their past success when they scale. Moreover, the fear of a public market reaction often permeates a public company’s collective psychology. This can prevent companies from taking risks necessary to deliver the innovation that ‘cornerstoned’ their founding; instead, miring the company in CYA decision-making for fear of a headline.

Well-managed private companies can act on long-term vision rather than short-term gains, empowering composed, intelligent management, not reactivity.

Combine the low-cost operation and long-term vision in great private companies, and investors stand to do well.

2. Private solar funds don’t have daily market fluctuations

The core investors in private solar funds are committed to the mission, so the whims of the day have no impact on the underlying fundamentals, the way they do for public stocks. There is no day trading manipulating the price in private funds, which can gut investor profits after one headline.

Public solar companies have hoards of thoughtless investors at their heels looking to make a buck, not to support the fundamental mission and vision of the company. Of course, speculators play a role in price discovery. Still, they also generate needless volatility that can be frightening for genuine investors and, at worst, decimate investor portfolios or raze good companies.

3. solar funds Earn profits from solar projects directly

We all know firms often deploy nebulous and sometimes ‘creative accounting.’ Anyone who has read the annual reports from public companies can vouch that disclosures are only understandable to people with advanced degrees in finance. But, of course, that is on purpose because they want you to be confused.

Public companies often hire the best lawyers and accountants to obscure reality by emphasizing potentially irrelevant yet flashy financials while downplaying material concerns.

It can be tough to know where investor profits are coming from in a public company. How leveraged is a company? Are earnings from stock buybacks or sales? Are yields based on murky assumptions of future growth or legitimate revenue?

Private fund owners can access financials because they own the company directly, and fund managers are a call or click away. The relationship in private companies is one of partnership, not arms-length obfuscation.

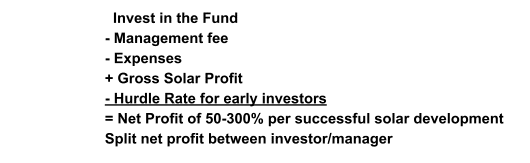

As an example of the simplicity, here is the profit formula for shares in the Summit Power Fund:

It’s as simple as that.

4. solar funds avoid burdensome regulatory requirements

Public companies, on the other hand, have to follow complex compliance rules, such as the Sarbanes Oxley Act of 2002. As a result, costs for upkeep on these burdens can be in the millions of dollars, cutting into ROI.

Because private funds aren’t spending profits on compliance, these profits go back out to investors.

There are certain advantages to private companies too. But, for accredited investors who want to know how their investments are performing, and have direct insight into their invested dollars, private solar funds like The Summit Power Fund are hard to beat.

Schedule a call to take your portfolio performance to the next level.