POSTED

April 5, 2024

Pros And Cons of Investing in a Utility-Scale Solar Farm Private Placement Fund

Accredited investors and those who care about environmental, social, and governance (ESG) factors are looking for fresh investment opportunities. They’re bored of the same old choices. They want investments that make them money and positively impact society. Let’s explore the benefits and risks of investing in utility-scale solar farm funds. These private placement funds are […]

Accredited investors and those who care about environmental, social, and governance (ESG) factors are looking for fresh investment opportunities. They’re bored of the same old choices. They want investments that make them money and positively impact society.

Let’s explore the benefits and risks of investing in utility-scale solar farm funds.

These private placement funds are for any accredited investor who wants to invest in a stable future for the planet. They offer opportunities for investors to balance making money with doing good.

Traditional investments face criticism for their impact on the environment and society. Utility-scale solar farm funds stand out as a way to invest in a sustainable future. Let’s take a closer look at how these funds are set up to meet the needs of savvy investors. Soon, you’ll understand why they’re becoming more popular in today’s investment world.

Understanding Utility-scale Solar Farm Private Placement Funds

Definition and Regulatory Framework

Utility-scale solar farm private placement funds allow accredited investors to invest in big solar energy projects. These investments are offered to a select group of investors and have rules to protect them. To invest, people must meet certain requirements, such as having a high income or a lot of money. Regulations make sure these investments follow specific standards to keep investors safe.

Explore the Role of Utility-scale Solar Farms in Renewable Energy Landscape

Utility-scale solar farms are essential for making more renewable energy. They’re big projects that produce clean energy from the sun. These farms are growing fast because more people want clean energy.

Utility-scale solar farms help fight climate change by reducing pollution and greenhouse gasses. Their future looks bright. Technology is improving. and support from governments and people who care about the environment is increasing.

ESG Considerations in Investment Decision-Making

Investors today care about more than just making money. They also think about how their investments affect the environment and society. Utility-scale solar farm investments fit well with these concerns. They support clean energy and help combat climate change. By investing in solar farms, people can support causes they care about while making money.

Pros of Investing in Utility-scale Solar Farm Private Placement Funds

High Returns and Wealth Accumulation

Clean energy is becoming popular. Investing in sustainable projects like utility-scale solar farms with private placement funds can lead to high returns.

Solar projects can provide a high income with a risk that decreases over a few years as returns are paid out. By investing in these funds, you can grow your wealth and protect the future of the planet.

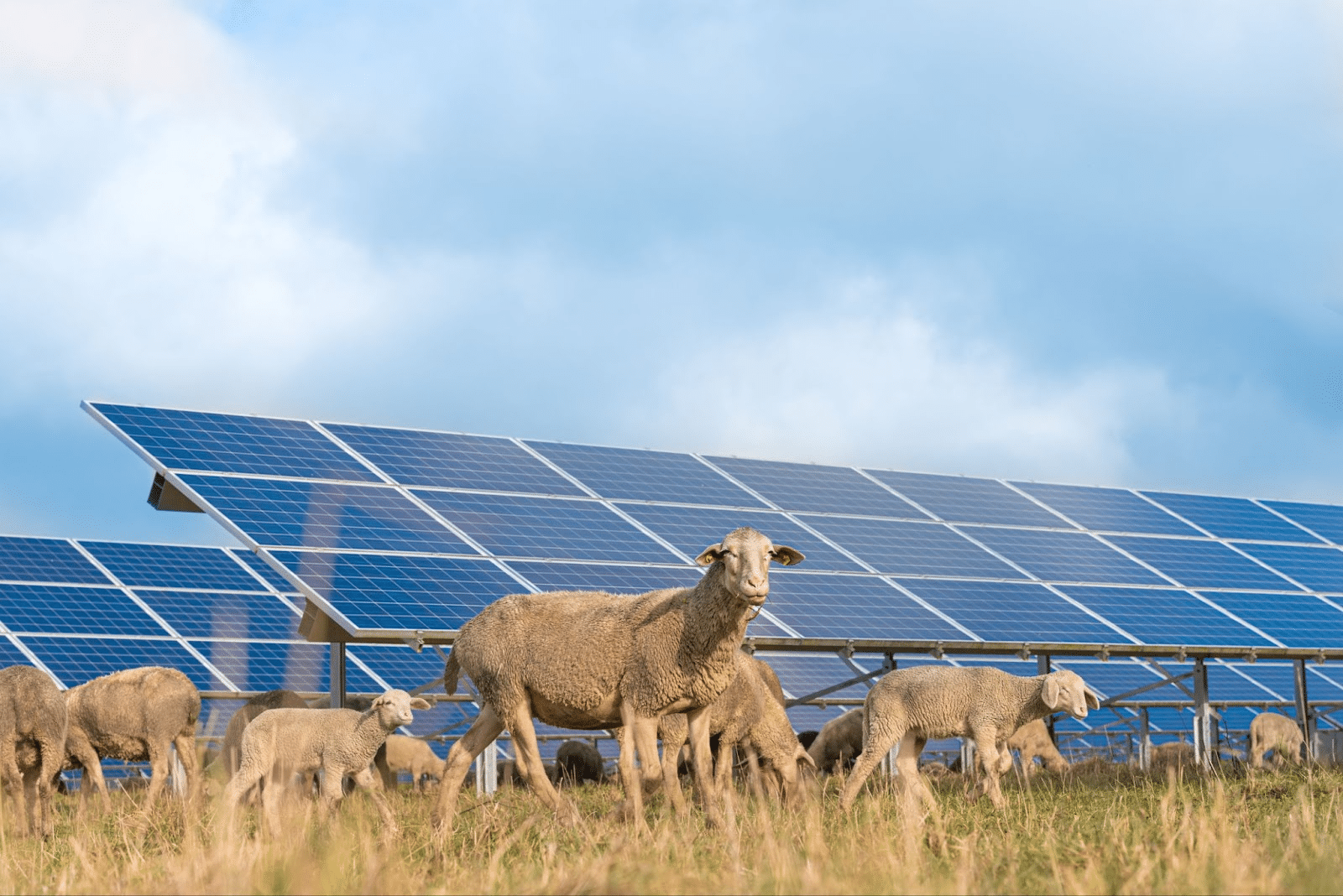

Environmental Impact and ESG Alignment

Utility-scale solar farm projects are good for the environment because they promote sustainability. Solar farms reduce pollution by replacing fossil fuels with clean energy. They also make good use of unused land. By investing in solar farms, you support efforts to make energy cleaner.

Portfolio Diversification and Risk Management

Adding utility-scale solar farm investments to your portfolio spreads out your investments and manages risks. Renewable energy projects don’t always move in the same way as traditional investments. They can help make your portfolio less risky altogether by diversifying it.

By investing in different kinds of assets like solar projects, you can protect yourself from big losses if one part of the market goes down. This builds a stronger and more stable investment portfolio generally.

Cons of Investing in Utility-scale Solar Farm Private Placement Funds

High Initial Investment Requirements

Investing in utility-scale solar farm private placement funds usually requires a lot of money upfront. These funds have minimum amounts that accredited investors must invest, which can be quite high. Investments like this might be tough for people who don’t have a lot of money to spare. Smaller investments could limit your chances of getting involved in these funds.

Lack of Liquidity and Exit Strategies

One downside of utility-scale solar farm private placement funds is that it’s not easy to get your money out fast. Unlike stocks, which you can sell anytime, these funds often have restrictions on when you can withdraw your money.

You might have to wait for a long time before you can get your investment back. You’ll need to be patient and willing to commit your money for a while to see any returns. To understand how returns are paid out with Shasta Power’s Summit Power Fund, check out our article How To Predict When You’ll Get Paid From A Commercial-Grade Solar Investment

Regulatory and Policy Risks

Investing in utility-scale solar farms comes with risks tied to government rules and policies. Changes in these rules, like incentives or tariffs for renewable energy, can affect how much money projects make.

If regulations change, it could impact the returns you get from your investment. Keeping an eye on government policies and how they might affect your investment is important to avoid surprises.

Technological and Operational Risks

Technology in the solar energy field is always changing, which can bring risks for investors. While new advancements can improve things, they could make older equipment obsolete. There are also challenges with keeping solar farms running like maintenance issues or problems with the power grid. Understanding these risks is crucial for investing in utility-scale solar farm projects.

Considerations for Accredited and ESG Investors

Due Diligence and Investment Research

Before investing in utility-scale solar farm private placement funds, you must do your homework. You should carefully examine fund managers, investment strategies, and what the funds are investing in. Take a close look at how well renewable energy investments have performed in the past. By researching, you can make smart choices and lower the chances of something going wrong with your investment.

Alignment with ESG Values and Objectives

Utility-scale solar farm investments match your values if you care about ESG issues. Think about how these investments impact the environment and society. Also, consider if the fund managers care about and aspire to ESG factors. By making sure your investments align with your values, you can support causes you believe in while making money.

Portfolio Allocation and Risk Management

Adding utility-scale solar farm investments to your investment mix requires careful planning. You need to figure out how much money to put into these investments and how to balance them with your other investments. Having a plan for managing risks is crucial so your investments stay safe. By spreading out your investments and managing risks, you can build a strong portfolio that helps you reach your financial goals.

Long-Term Investment Horizon and Wealth Planning

Investing in utility-scale solar farm projects should fit into your long-term plans. This way, you grow your wealth and achieve your ESG goals. Think about how these investments fit into your full wealth-building strategy. By including utility-scale solar farm investments in your long-term plans, you can work towards building a financially secure future while making a positive environmental impact.

Shasta Power Renewable Energy Project Conclusion

We have covered utility-scale solar farm private placement funds and what they mean for investors, especially accredited investors or those who value ESG factors.

These funds hold great promise for investors who want to make money while supporting clean energy initiatives. Investors must weigh the pros and cons of these investments based on their goals and values.

We urge investors to do their homework. You must weigh the risks and benefits and consider seeking advice from financial experts. These steps allow investors to make informed decisions that match their unique needs and beliefs.

In sustainable investing, utility-scale solar farm private placement funds offer exciting possibilities. If you’re intrigued, take the next steps. Research, analyze, and consult. This way, you can ensure your investment journey is financially rewarding and environmentally impactful.

If you’re interested in exploring utility-scale solar farm private placement funds further, explore the Summit Power Fund. Learn how you can be part of the clean energy revolution and build a robust investment portfolio.