POSTED

May 3, 2024

How Does A Solar Farm Work For Investors?

As the investment landscape keeps changing, accredited investors and those who care about Environmental, Social, and Governance (ESG) factors are looking for new ways to make money while doing good. One exciting option gaining popularity is solar farm investing. This specialized opportunity offers big financial gains and also supports sustainable energy projects. In this article, […]

As the investment landscape keeps changing, accredited investors and those who care about Environmental, Social, and Governance (ESG) factors are looking for new ways to make money while doing good. One exciting option gaining popularity is solar farm investing. This specialized opportunity offers big financial gains and also supports sustainable energy projects. In this article, we’ll explore how solar farm investing works and explain why it appeals to accredited and ESG-focused investors, all through the lens of Shasta Power’s innovative renewable energy investment strategy.

Understanding How Does A Solar Farm Works For Investors

Solar farm investing is an alternative investment focused on financing solar energy projects. These projects range from big utility-scale solar farms to smaller community initiatives. It’s about helping solar energy grow while making money.

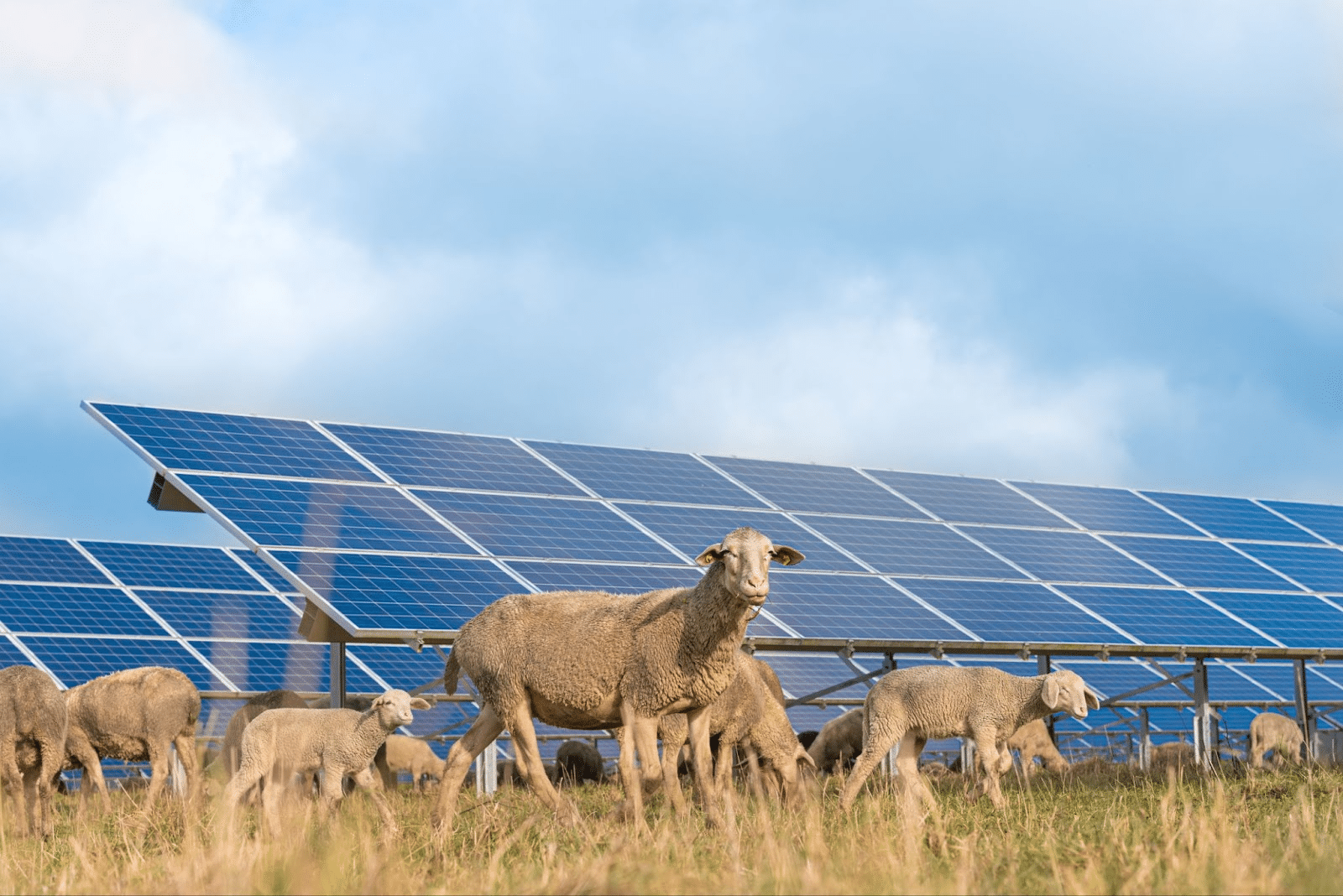

Solar farms work by using either photovoltaic (PV) panels or concentrated solar power systems to capture sunlight and turn it into electricity. PV panels have solar cells that soak up sunlight and make direct current (DC) electricity. Concentrated solar power systems use mirrors or lenses to focus sunlight onto a small area. This system creates heat that drives turbines to make electricity. Thanks to advancements, solar panels are now more efficient and reliable, making solar farms a real competitor to traditional energy sources.

Solar energy is super important in the big picture of global energy. It helps diversify energy sources, cut down on carbon emissions, and fight climate change. With the growing demand for clean energy, solar farms are becoming a key part of the solution. By investing in solar farm projects, people can play a part in building a cleaner, more sustainable future.

Options for Solar Farm Investing

Direct Market Investments

Accredited investors can directly invest in specific solar farm projects. This means they can buy a part of the project by getting equity stakes or shares. There are different ways to finance these investments, like project financing or partnerships. Investors can also enjoy tax benefits like the Investment Tax Credit (ITC) and depreciation allowances. This can help investors save money.

Private Solar Funds

Private investment funds focused on solar energy projects offer a detailed analysis for accredited investors looking to diversify their investments and get expert management. Professionals oversee these funds to ensure they are made to fit the investors’ needs.

The investment thesis of private solar funds explains how they pick and handle solar projects. They spread investments across different projects to lower risks and boost returns.

To manage risks, private solar funds use strategies to spot and deal with potential problems. These strategies include careful research, legal protections, and keeping an eye on project performance and market conditions.

Investors need a minimum amount to join these funds, which is set by each fund. Potential returns depend on how well the solar projects do and how well the fund sticks to its investment plan. Investors need to think about these factors before investing.

Solar Bonds

Solar bonds are like loans to solar energy companies or projects. They give accredited investors a chance to earn a fixed income from renewable energy. Investors lend money to solar projects through these bonds and get regular interest payments in return.

It’s important to check the creditworthiness of solar bonds to decide if they are a good investment. You should look at things like the project’s financial performance, the quality of the company buying the solar power, and any extra protections in place to lower risk.

Investing in solar bonds has both risks and rewards. While they can offer steady returns, there’s a chance that projects may not perform well, a default on the bond payment can occur, or the market conditions could change. Still, with careful thought and research, solar bonds can be a good way to earn money while supporting clean energy.

ESG Stocks

For people who want to invest in a way that helps the environment, there are Environmental, Social, and Governance stocks in the renewable energy sector. These stocks come from companies that work on solar energy projects.

To find the right companies to invest in, we look at their money situation, how they’re doing in the market, and their ESG credentials. We check things like income, growth, and debt management. We also look at how they stand against their competitors and if they have good partnerships.

When we talk about ESG credentials, we’re looking at how these companies impact the environment, help society, and run their business. By studying these factors, investors can find stocks that make money and do good for the planet and the community.

Benefits of Solar Farm Investing

Projected Land ROIs

Investing in solar farms can bring promising returns through long-term contracts with utility companies or power purchase agreements (PPAs). Additionally, as the demand for renewable energy grows, the value of solar assets could grow over time, which means investors might see their investment grow in value. Solar farm investments offer high-income projections and the potential for long-term growth. These investments are an appealing choice for investors looking for high projected profit.

Positive Environmental Impact

Investing in solar farms brings financial gains and helps the environment in big ways. Solar energy is clean and renewable, reducing harmful greenhouse gas emissions and air pollution compared to fossil fuels. By supporting solar projects, investors help lessen our dependence on finite fossil fuel resources. They can promote sustainability and protect the environment.

Accredited and ESG investors play a key role in this shift towards renewable energy and sustainability. By investing in solar farms, they support the growth of clean energy infrastructure, helping speed up the move away from fossil fuels. This, in turn, helps fight climate change and protects natural ecosystems. Through their investments, accredited and ESG investors contribute to a cleaner, greener future.

Portfolio Diversification

Adding solar farm investments to a well-balanced portfolio is a smart move for accredited investors. It helps spread out risks across different types of investments, which can protect against losses. Solar farm investments offer a chance for growth and income that’s not tied to how stocks or bonds perform. These investments have the potential to provide high returns even if other parts of the portfolio aren’t doing as well, boosting the overall performance.

Investing in solar farms also has a high income potential. Investors can benefit from solar energy without having to deal with the day-to-day operations of a solar farm.

Solar Energy Farm Investing Project Conclusion

Investing in solar farms is a smart move for accredited and ESG investors who care about both making money and helping the planet. By putting their money into solar farms, investors can use their financial power to make a positive impact on the environment while also aiming for good returns on their investments. Investors need to take their time and do thorough research before diving in. If needed, seeking advice from professionals can be helpful. There are plenty of different solar investment options out there, so investors should explore their choices.

By choosing to invest in solar farms, investors are not just making a financial decision; they’re also becoming part of a global movement towards cleaner and more sustainable energy. They can be proud of their investments, knowing they’re contributing to a better future for everyone.

So, whether it’s for financial gain, environmental impact, or both, solar farm investing is a smart choice for investors who want to make a difference while growing their wealth. For more information and to explore solar investment opportunities, visit Shasta Power’s Summit Power Fund today!