POSTED

January 26, 2024

How Long Does It Take to Get a Return from Solar Farm Investing

How Long Does it Take to Get a Return from Solar Farm Investing? Investing in utility-scale solar farms is a smart choice that goes beyond making money. It shows your commitment to using sustainable practices and supports the future of renewable energy. Shasta Power wants to help you understand what investing in utility-scale solar farms […]

How Long Does it Take to Get a Return from Solar Farm Investing?

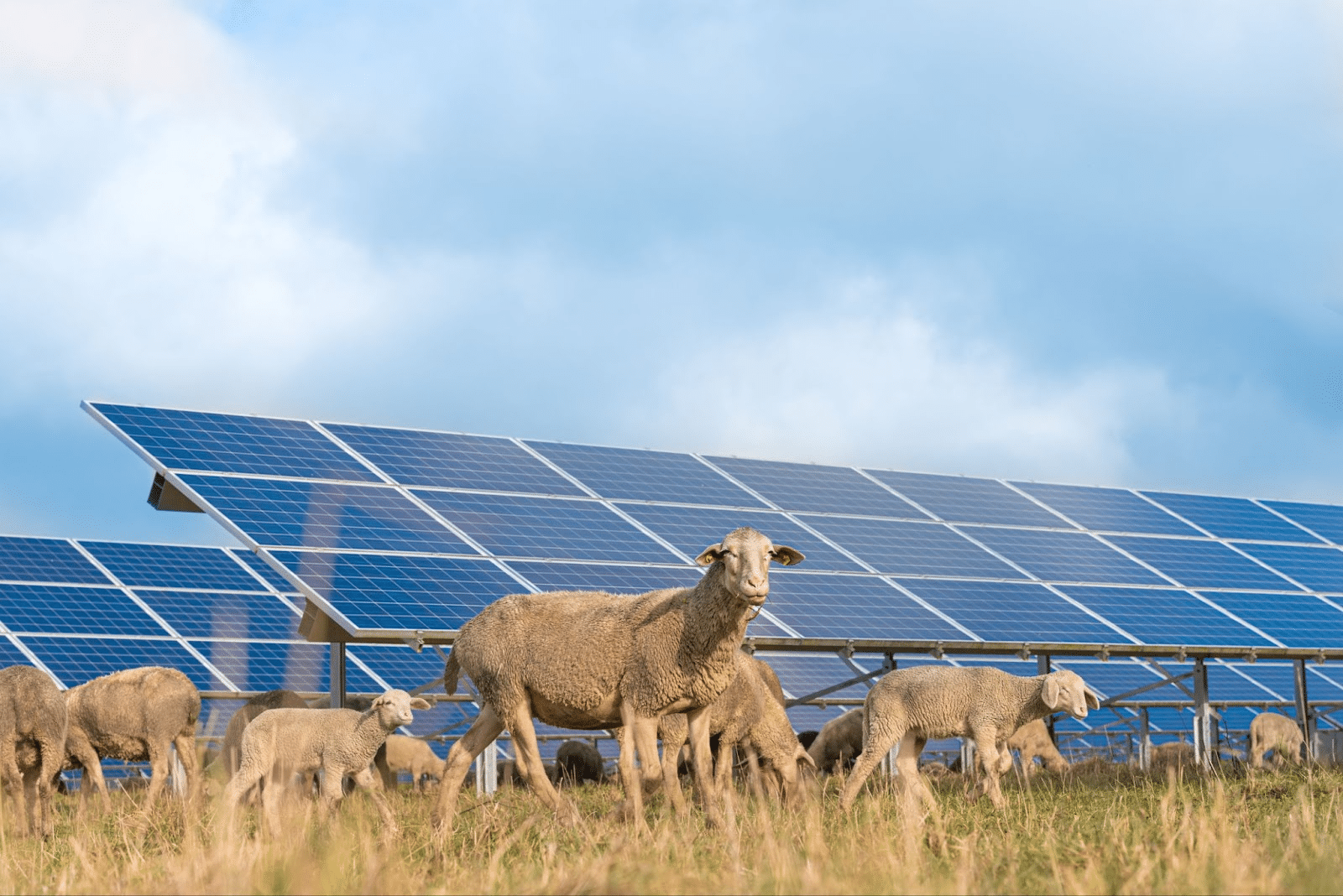

Investing in utility-scale solar farms is a smart choice that goes beyond making money. It shows your commitment to using sustainable practices and supports the future of renewable energy.

Shasta Power wants to help you understand what investing in utility-scale solar farms looks like—particularly so you can fully understand what goes into achieving a high return.

That said, many potential investors have the same question: How long does it take to start seeing returns on my solar farm investment?

In this article, we will cover the different variables that affect how much money you make when investing in solar farms. You will also learn about the various aspects that influence your returns on investment while supporting sustainable and impactful choices.

Understanding Solar Farm Investing

Understanding solar farm investment returns will require grasping its fundamental concepts.

To start, solar farms harness sunlight and use panels to convert it into electricity. The solar farms then sell that electricity into the wholesale energy market.

Shasta Power is a renewable investment fund that adopts a strategic approach to solar investing by developing solar farms and selling the assets to major companies during the early and middle stages of development.

Our investors see early payouts and receive the benefit of their assets’ rapid early-stage appreciation.

The Benefits of Solar Power and Solar Investing

For investors who can handle some risk, the chance to earn high returns in the growing solar energy market makes this investment appealing. Solar farms offer a chance for risk-adjusted returns.

Once a solar farm has signed a long-term energy contract with a utility and is constructed, solar energy production and income are steady. This promise of stable profits makes early and mid-stage solar farms valuable even before they’re operational.

But investing in solar farms is not just about making money. It’s also about helping the environment by reducing the use of fossil fuels, lowering carbon emissions, and supporting global efforts for sustainability.

Investing in solar farms greatly impacts the investor and the environment. It’s not just about growing an investment portfolio; it’s also about contributing to a better, more sustainable future. Investors are important in leaving a positive mark on the environment by being part of the renewable energy sector.

Investment Timeline in Solar Farms

Starting a solar farm investment journey also means understanding how the timeline works for making money. The journey starts with careful planning, moves on to actual construction, and ends with the farm running efficiently.

If you want to know when you’ll start making money, check out Shasta Power’s guide, How To Predict When You’ll Get Paid From A Commercial-Grade Solar Investment. It has important milestones to consider when thinking about investing in solar.

Milestone 1: Planning

First, we start with careful planning. A plan creates a roadmap for the solar project’s journey. During this phase, the team thinks through the solar farm project and obtains all the necessary land rights, grid interconnection and permitting approvals. At this point, investors may start seeing returns, which means they begin getting paid.

The timeline for future returns depends greatly on how well the solar farm’s construction phase goes. Once the farm is up and running, it starts making money; that’s when most long-term solar investors begin to see returns.

Milestone 2: Construction

The next big step is the construction phase, when the building of the solar farm begins. Think of it as turning a drawing into a real building. The time to build the solar farm can vary, and delays might happen. The quality of the construction is crucial because it affects when the solar farm starts making money. In many solar funds, investors begin to see returns once the farm is up and running.

For those who want to see results quickly, Shasta Power has a strategic approach. We’ve discovered how investors can make a lot of money in a short time, typically within 3-6 years.

That said, no matter the project, bold investors can make a good amount of money investing in solar farms. Every phase of the journey is important and shapes the returns investors can expect.

Investing in solar farms is like embarking on a multifaceted adventure. Each phase requires careful consideration and informed decision-making. As we explore the intricacies of different factors that influence returns, we’ll uncover more details about the factors that shape returns to make the most of the solar farm investment experience.

Factors That Influence Returns

How quickly you make money in solar farm investing depends on a couple of primary factors that need careful consideration. The details of the specific project, like how solid the contracts are and the effectiveness of financial structures, play a big role.

Changes in Inputs/Outputs

Moving through the different stages of the project, from inception to construction, also impacts how fast you see returns. At the same time, the bigger picture—things like changes in rules and shifts in how much solar energy is needed—also affects how long it takes to see a return on a long-term investment.

Types of Solar Power Investment

Making money from solar farm investments comes in different ways, such as getting regular rent from a land lease, making money over time through energy payments, or appreciating the value of your investment over time.

If you choose to work with Shasta Power’s Summit Power Fund, there’s a unique aspect to consider. Thanks to smart strategies like Project Sales, and Milestone Payments, returns come in even before the construction phase.

These strategies speed up the time it takes to make money and set a new standard for a quick and dynamic return on investment. That said, it’s important to remember that many complex elements decide the speed and nature of making money in the ever-changing world of solar farm investing, and every investment will look different.

The Impact & Value of a Solar Farm Investment

Investing in solar farms is a smart move for people like you who want to strengthen their investment portfolios without being affected by the ups and downs of regular markets.

Peace of Mind Return

Adding this type of renewable energy investment helps reduce the risk of problems caused by frequent market changes. Solar farm investments can bring in a lot of money, but it’s important to remember the risks.

Internal Rate of Return

The current Internal Rate of Return (IRR) is impressive when you invest with Shasta Power, ranging between 20-40%.

This number shows the potential for making a significant profit. However, it’s a reminder that aiming for such high returns also comes with risks. Investors must find the right balance between wanting to make a lot of money and managing the risks carefully in the changing world of solar farm investments.

Environmental Return

Solar farm investment is a commitment to a future that’s good for the environment and a smart move toward using renewable energy.

Invest with Shasta Power

Investing in solar farms fits in with goals like keeping wealth safe, effortlessly making money, and managing risks.

Exploring the potential of Shasta Power’s big solar farm investments is a smart addition to your overall investment plan.

Check out Shasta Power’s free on-demand webinar about 3 Smart Reasons to Invest in Solar. You will learn more about how to make smart decisions that match your money goals and the need for investments that are good for the environment.