POSTED

July 19, 2024

Impact Investment: How Environmentally Conscious Investors are Changing the World

Money is more than a medium for exchanging value or measuring wealth. When invested with intention, it can be a significant driver of social change. Aligning investments with your personal values is even more important today as the world looks to create an environmentally sustainable future.

There has been a substantial shift toward environmentally and socially conscious investing in recent years. More and more, investors are looking beyond turning a profit and seeking to make a positive impact on the world. This trend toward values-aligned investing is largely influenced by evolving investor priorities and emerging regulatory frameworks that mandate environmental transparency and accountability.

One way environmentally and socially conscious investors can work toward aligning their values with their investments is through impact investing. This form of investment aims to create positive social and environmental impacts while generating financial returns. It is also distinct from Environmental, Social, Governance (ESG) investing.

Investors primarily approach ESG investing through the lens of risk management. It is more about filtering investments based on how well companies manage their ESG risks and opportunities. Impact investing, however, is less about risk management and more focused on generating measurable social or environmental benefits. In this article, we’ll look at impact investing, its benefits, and how Shasta Power can offer opportunities for environmentally conscious investors.

Understanding Impact Investment

Impact investing is a shift from traditional investment strategies. It prioritizes two objectives: financial performance and a positive, measurable social or environmental impact. Here are the key principles that guide impact investing.

Goal Definition and Intentionality

Clearly defining the social or environmental outcomes you hope to achieve with your investment is critical. This intentionality should be explicit and form the foundation of impact investing.

Financial Returns

Investors can expect impact investments to generate a financial return on capital or, at least, a return of capital. The range of expected returns can vary from below market to market rate, and this is entirely dependent on individual strategic goals.

Impact Measurement and Reporting

When they start impact investing, investors commit to measuring and reporting their investments’ social and environmental performance of their investments. This is essential for ensuring the investments are actually making a positive difference and helps guide the investment strategy.

Investors can engage in impact investing across multiple sectors. For example, impact investors can look for opportunities to increase access to quality education for underprivileged communities by investing in educational platforms and infrastructure. Funding innovative healthcare solutions that improve access to medical care for marginalized populations is another way for investors to make a positive social impact.

The Rise of Environmentally Conscious Investing

Impact investing is on the rise. Current estimates place the size of the worldwide impact investing market at $1.2 trillion. Impact investing is also gaining mainstream acceptance with a growing trend toward incorporating impact assessments across wider investment portfolios, not only within niche strategies.

Impact investments are also seeing a significant shift toward investments that address climate change and increase sustainability. In fact, more than 50% of individual investors say they anticipate increasing their allocations to sustainable investment. New climate science findings and the attractive financial returns of sustainable funds drive this trend. In the first half of 2023, for example, sustainable funds saw a median return of 6.9%. This beat traditional funds, which saw an average of 3.8% median return in the same period.

The Benefits of Impact Investment

Impact investing can offer a range of benefits, both financial and non-financial. Financially, it can help diversify investments across different sectors and geographies, potentially reducing risk and volatility. Contrary to some belief, impact investments can also match or exceed the performance of conventional investments. In 2020, over 80% of impact investors reported that their investments met or exceeded their financial expectations. What’s more, one study shows that impact funds have a median internal rate of return (IRR) of 6.4%, only slightly lower than impact-agnostic funds with a median IRR of 7.4%. They can also be less sensitive to economic downturns since they often target sectors like healthcare, education, and agriculture.

Beyond financial returns, the primary appeal of impact investing is its focus on generating positive impacts, driving crucial societal changes. These investments also typically involve closer relationships with stakeholders, leading to stronger community ties and helping increase positive social outcomes. Funding businesses and projects that conventional financial markets might overlook is also a way to drive innovation and promote economic inclusion. This can help develop underserved regions and create new industries and technologies.

One real-world example of successful impact investing is EM3 Agricultural Services in India. Supported by Aspada, an impact investing fund established by the Soros Economic Fund, it significantly enhanced productivity for smallholder farmers. Not only did this improve agricultural output, but it also attracted additional capital. Another example is Launch Capital Partners. They have been instrumental in developing multifamily housing projects that address the housing needs of underserved communities.

Utility-Scale Solar Farms: A Prime Opportunity

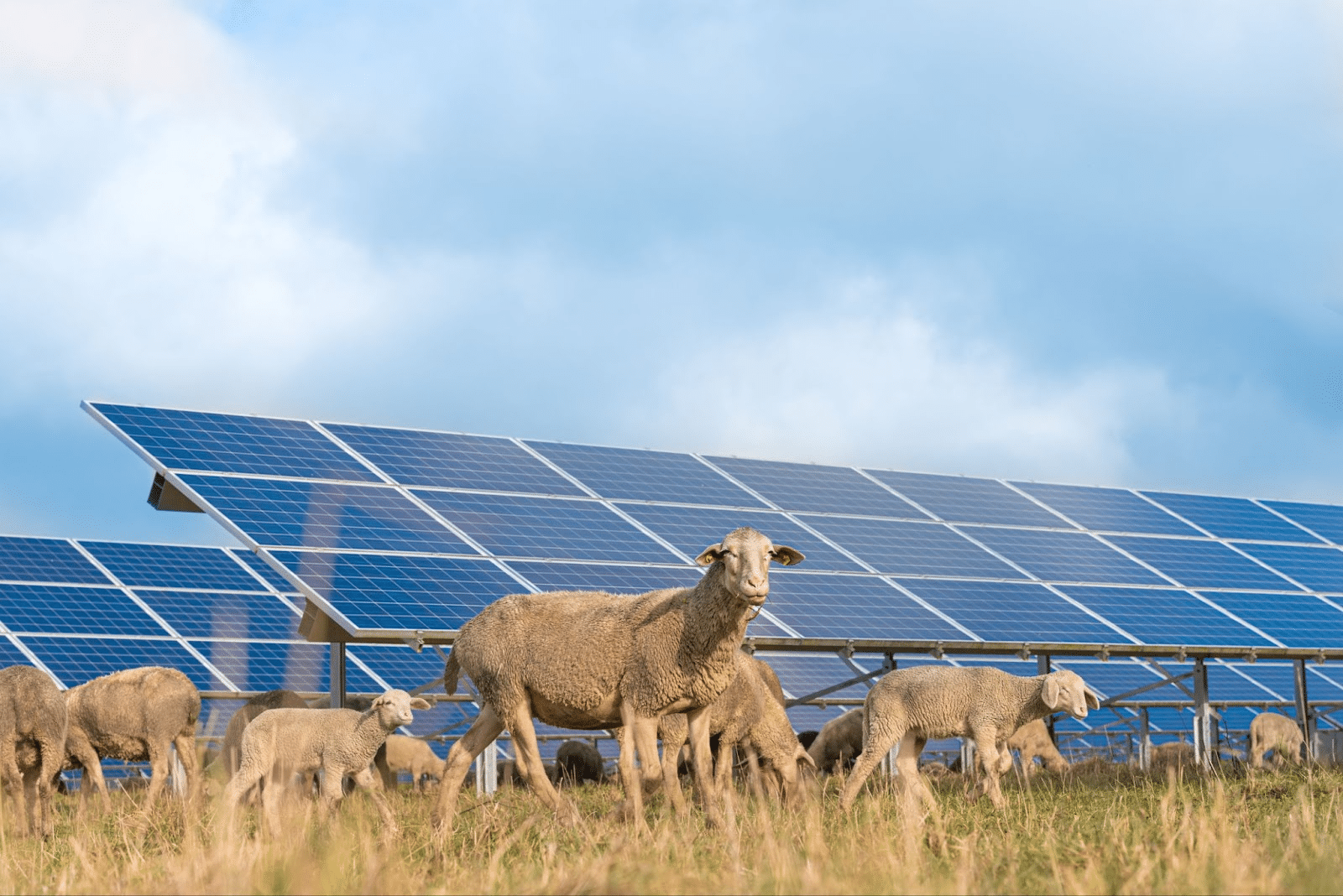

Solar farms play a large role in driving environmental change. They provide a renewable source of energy and reduce greenhouse gas emissions. The land under and around solar panels can also be used to support native vegetation, providing habitats for wildlife. This helps preserve ecological balance and increases biodiversity.

Utility-scale solar farms also provide substantial economic benefits. They can generate hundreds of jobs during their construction and operation. They also often lead to local infrastructure improvement, including upgrades to roads and bridges and enhancements to the electrical grid. Solar farms can also help communities reduce their dependence on imported fuels by generating power locally, increasing their energy security. This is particularly beneficial for remote or underserved areas with unreliable energy access.

Shasta Power is dedicated to helping communities realize the environmental and economic benefits of solar power. From land acquisition to securing financial investments to project management and implementation, we play a pivotal role in the development of utility-scale solar farms.

Our Summit Power Fund also gives investors an opportunity to be a part of creating a sustainable future. It focuses on eliminating coal usage and promoting clean, renewable solar power. This fund aims to provide substantial returns to investors while also positively impacting the environment by reducing reliance on fossil fuels.

Partner With Shasta Power

By investing with Shasta Power, you support a shift toward a sustainable energy future. We give you the opportunity to align your financial investments with your values, ensuring your investments are impactful and sustainable. We also offer investors the potential for substantial returns on investments. Our Summit Power Fund typically targets returns between 50% and 200% on a per project basis.

Shasta Power makes it easy for you to start making an impact with your investments. Simply create an account, verify your accredited status, sign the subscription agreement, and then wire your investment to the Summit Power Fund.

Clean, renewable solar energy has the potential to reduce carbon emissions, strengthen our communities, and build a sustainable future. Investing in utility-scale solar farms through Shasta Power can give you a unique opportunity to help reverse the effects of climate change.

As we try to overcome the challenges of the modern world, it’s more important than ever for investors to consider their investments’ social and environmental impact. Investors are increasingly understanding the social and environmental benefits of impact investing. It allows you to help create real, positive change in the world. It can also be a good way to potentially see financial returns and diversify your portfolio.

Want to learn more about Shasta Power? Visit our investment information page and discover how we are helping investors make a positive environmental impact and see all the opportunities available for impact investment.